- Together We Trade

- Posts

- New Post

New Post

Apple's New Smart Display Confirms What This Startup Knew All Along

Apple has entered the smart home race with its new Smart Display, firing a $158B signal that connected homes are the future.

When Apple moves in, it doesn’t just join the market — it transforms it.

One company has been quietly preparing for this moment.

Their smart shade technology already works across every major platform, perfectly positioned to capture the wave of new consumers Apple will bring.

While others scramble to catch up, this startup is already shifting production from China to its new facility in the Philippines — built for speed and ready to meet surging demand as Apple’s marketing machine drives mass adoption.

With 200% year-over-year growth and distribution in over 120 Best Buy locations, this company isn’t just ready for Apple’s push — they’re set to thrive from it.

Shares in this tech company are open at just $1.90.

Apple’s move is accelerating the entire sector. Don’t miss this window.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Hello Traders,

Last week, we officially entered "Correction" territory on the S&P 500—though, I'm sure you've heard that a hundred times by now, considering every talking head is endlessly repeating the same data points. The Nasdaq, however, had already crossed this threshold the week before, with a peak drawdown exceeding -13.5%. While the pain at the individual stock level has been sharp, it's actually quite par for the course on an index level, as history tends to remind us.

INDEXES

SPY | -2.28% |

QQQ | -2.47% |

IWM | -1.49% |

DIA | -3.01% |

BREADTH OUTLOOK

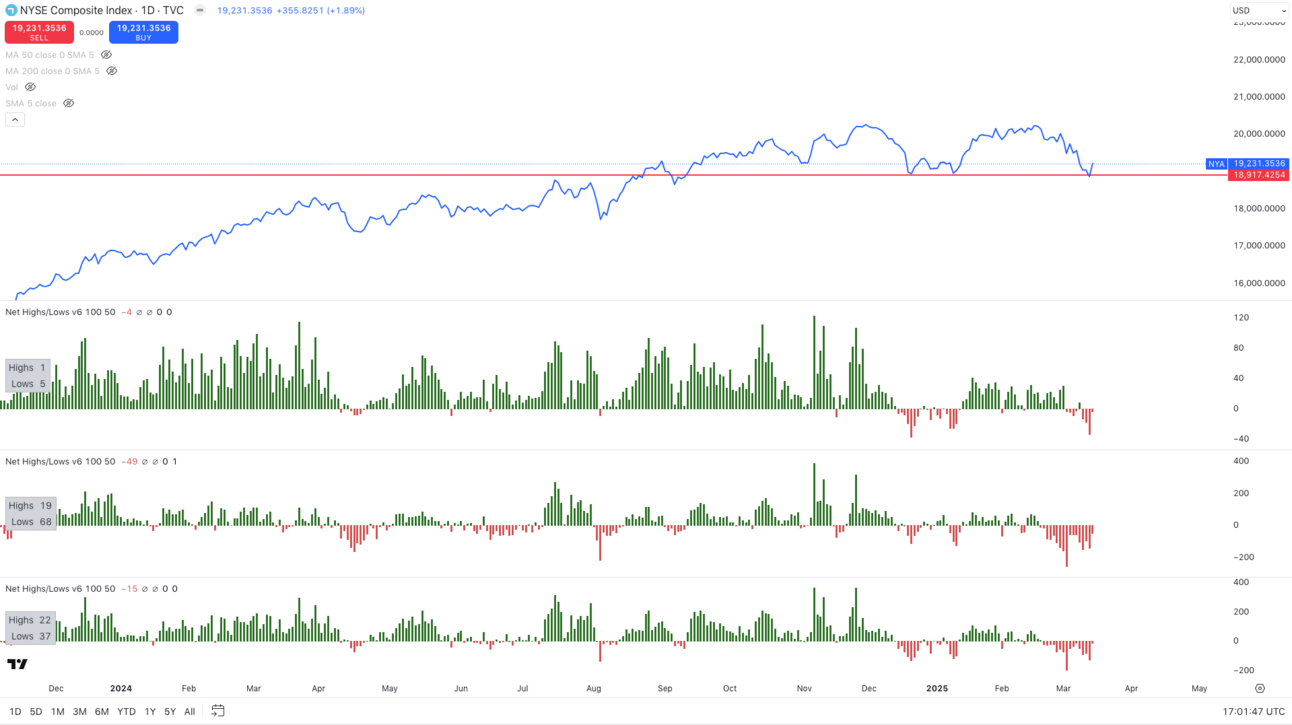

Below is a line chart of the NYSE, accompanied by the net new highs/lows for the S&P 500, Nasdaq, and NYSE, respectively. The expansion in net new lows persists, though I am hopeful that we will begin to observe some positive shifts in the net new highs/lows over the coming weeks.

The markets still have considerable work ahead. While we saw a modest bounce on Friday, it wasn’t enough to justify a full risk-on approach just yet. Follow-through and a bit more time are needed, in my view, before a more confident shift in positioning. Heading into the week, I plan to remain patient but remain open to deploying capital selectively if compelling opportunities arise.

One area of the market I’ve been watching closely is semiconductors, specifically the SMH –Semiconductor ETF. Semiconductors were among the first to lead the market lower triggered by the DeepSeek fiasco (partially), yet the Semi’s ETF itself, despite the pain many names have experienced, appears to be in a standard consolidation within a broader uptrend. Of course, breakdown risks remains, which would not be good for the market, but if SMH firms up and participation strengthens across the sector, it could provide some fuel to the broader market, helping reignite momentum. Some food for thought.

TICKERS

AMZN, GLF, MDT, BABA, ATAT, EH, SLF, PAAS, NGD, TAL, ALKS, EWTX, KGC, AMD

I’ve decided to revert back to my original approach with this newsletter and provide some general commentary around each chart. Ultimately I will usually share fewer charts, but give some proper breakdown on what’s happening within those setups. This has been communicated from others, that they find it of more value.

Let’s get into this weeks charts!

AMZN – Amazon: The stock has retraced to its initial breakout zone from October, revisiting a key technical level. Amid the broader market's corrective phase, AMZN pulled back but is now rebounding off this former resistance, which has the potential to act as support. If this level continues to hold and broader market conditions stabilize, it could present an opportunity for upside continuation.

GLF – Environmental Inc.: The stock recently broke out of a multi-year base and has since retraced to retest the breakout level, which has thus far held as support. It remains in a consolidation phase above this key level, with price action suggesting the potential for a continuation of the uptrend.

MDT – Medtronic: The stock has been forming a multi-year bottoming base and recently achieved a breakout above key resistance, defying broader market weakness. Price action remains constructive, holding above the breakout level, suggesting the potential for continued upside momentum.

BABA – Alibaba: Following a strong rally out of a multi-year bottoming base, Alibaba continues to show impressive relative strength, holding well above its prior resistance level. The stock remains in a tight consolidation, signaling the potential for further upside. Notably, Chinese equities have shown resilience in recent sessions, adding conviction to this setup.

ATAT – Atour Lifestyle Holdings: The stock recently broke out of a multi-year cup-and-handle formation and has since retested its breakout level, which is now holding as support. If broader market conditions stabilize, the technical setup favors a potential continuation to the upside.

EH – EHang Holdings: Another Chinese stock displaying constructive price action, EH formed a substantial bottoming base and initially attempted a breakout several weeks ago. Although it briefly pulled back below resistance, it began reclaiming that level last week, suggesting a potential second breakout attempt may be underway.

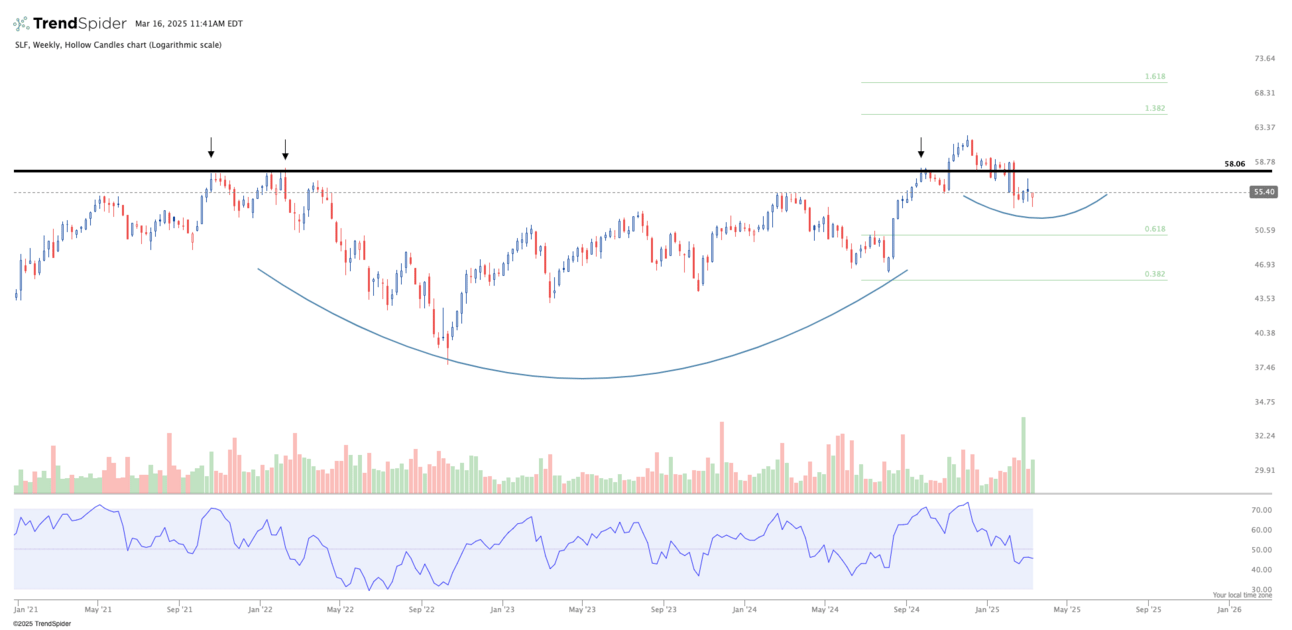

SLF – Sun Life Financial: The stock recently attempted a breakout from a massive multi-year base but failed to sustain above the breakout level following a weak earnings reaction. I’m closely watching the February lows as a critical support level. As long as price holds above this area, SLF presents an intriguing low-risk entry with the potential for a second breakout attempt in the coming weeks—potentially forming a cup-and-handle pattern. However, a breakdown below those February lows would invalidate the setup.

PAAS – Pan American Silver: The daily chart exhibits a potential cup-and-handle formation, with price currently testing key resistance. The recent strength in silver provides a constructive backdrop for the stock, but a decisive breakout is needed to confirm the next leg higher.

NGD – New Gold Inc.: The stock broke out of a multi-year base in August 2024 and has since established a healthy consolidation above its former resistance level. It is now making an attempt to surpass its previous highs, signaling the potential for the next upward leg. The ongoing rally in gold provides a favorable backdrop for further strength in this stock.

TAL – TAL Education Group: Another Chinese stock exhibiting promising potential. Following a strong rally from the 2022 lows, TAL has spent over a year consolidating. It recently tested its 52-week highs and is now forming a tight consolidation just below resistance. I’m monitoring this for a potential breakout above this key level.

ALKS – Alkermes: The stock has successfully broken out from a multi-year base and is now retesting the breakout level in a constructive manner. As long as the breakout level holds and continues to act as support, the setup looks favorable for continued upside.

EWTX – Edgewise Therapeutics: The stock is forming a clean cup-and-handle pattern. After testing the upper resistance zone a few months ago, it appears to be constructing the handle. Notably, price has not breached the January lows, instead consolidating sideways. As long as this level holds, the chart suggests a strong potential for a breakout in the coming weeks or months.

KGC – Kinross Gold: The stock recently broke out of a significant multi-year base and has since retested the breakout level. It is now experiencing a bounce, which suggests a high likelihood of continuation to the upside.

AMD – Advanced Micro Devices: The stock has been under significant pressure for several months and is now testing the $100 level, which has served as support on multiple occasions in the past. This psychological threshold often acts as a critical point of support and resistance. As long as the price holds above this level, the potential for a rebound is promising. While I do not expect a swift recovery, with patience, this could present an excellent longer-term opportunity.

Have a great week ahead. Remember there is an FOMC rate decision meeting on Wednesday. Expect additional volatility!

Together We Trade