- Together We Trade

- Posts

- New Post

New Post

This smart home company grew 200% month-over-month…

No, it’s not Ring or Nest—it’s RYSE, a leader in smart shade automation, and you can invest for just $1.75 per share.

RYSE’s innovative SmartShades have already transformed how people control their window coverings, bringing automation to homes without the need for expensive replacements. With 10 fully granted patents and a game-changing Amazon court judgment protecting their tech, RYSE is building a moat in a market projected to grow 23% annually.

This year alone, RYSE has seen revenue grow by 200% month-over-month and expanded into 127 Best Buy locations, with international markets on the horizon. Plus, with partnerships with major retailers like Home Depot and Lowe’s already in the works, they’re just getting started.

Now is your chance to invest in the company disrupting home automation—before they hit their next phase of explosive growth. But don’t wait; this opportunity won’t last long.

Hello Traders,

Not a bad week in the markets overall. Clearly some rotation back into those big tech names, and the Magnificent 7 stocks. Out of the 5 trading days this past week, the Nasdaq locked in a 4 new all time high readings and closed at all time highs to finish the week.

QQQ | +3.28% |

SPY | +0.87% |

IWM | -1.22% |

DIA | -0.65% |

Bit of a shorter list this week, but nonetheless, let’s get into this weeks charts:

AZO - AutoZone: Putting in a nice tight mutli-month base breakout. Chart looks actionable right where it sits. As long as it remains over the line I am interested.

YMM - Full Truck Alliance: A really nice multi-year bottoming base breakout, supported by a solid increase in volume. As long as price remains above the line I am interested in being long.

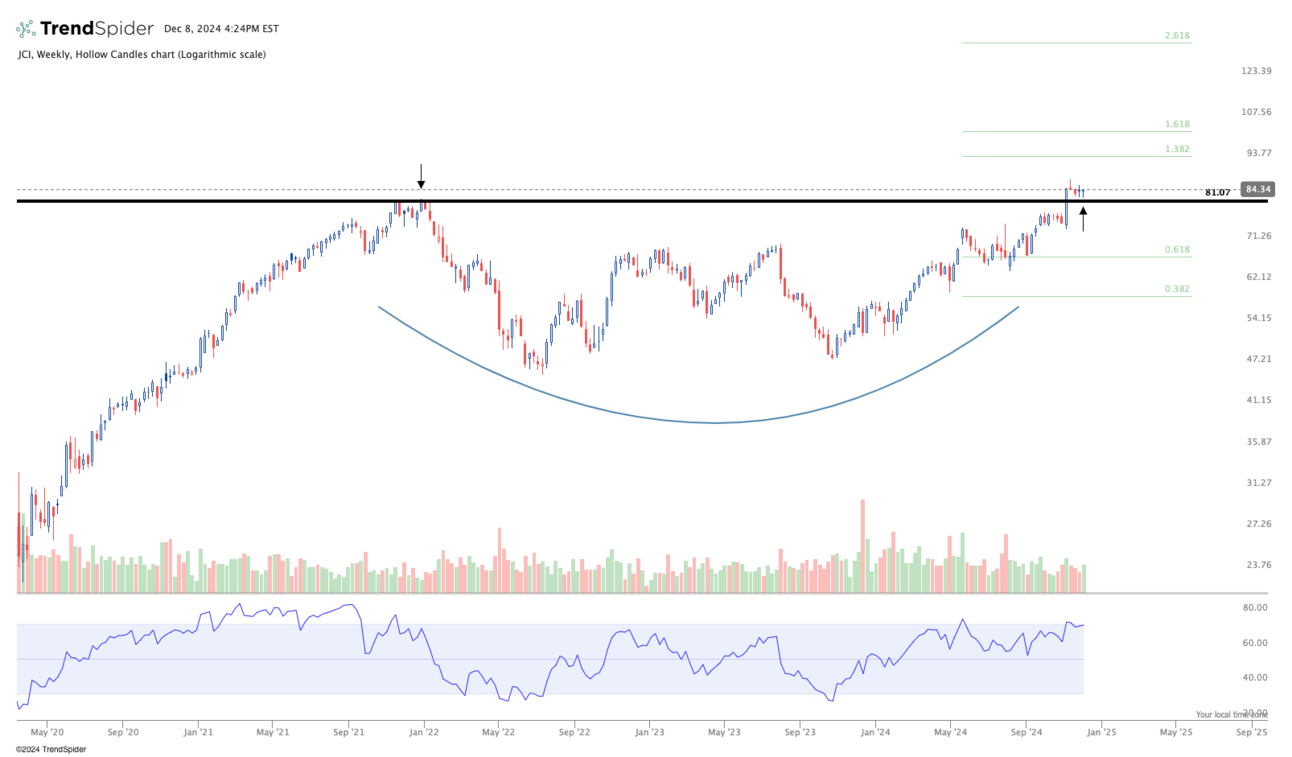

JCI - Johnson Controls International: This chart was shared last week. It remains in good constructive shape, after having broke out of a massive multi-year base. It continues to nicely consolidate just above support. As long as it holds over the line, I am interested.

HRI - Herc Holdings: This chart is a really nice clean multi-year base breakout. Its currently coiling above support, and looks like it may want to continue to the upside. There is always the possibility this pulls back to put in a hard retest before moving higher. Regardless I still like this chart as long as it holds over the line.

AZEK - The AZEK Company: Breaking out of a multi-year cup & handle pattern. The chart looks actionable right where it sits. As long as it can hold over the line, I am interested.

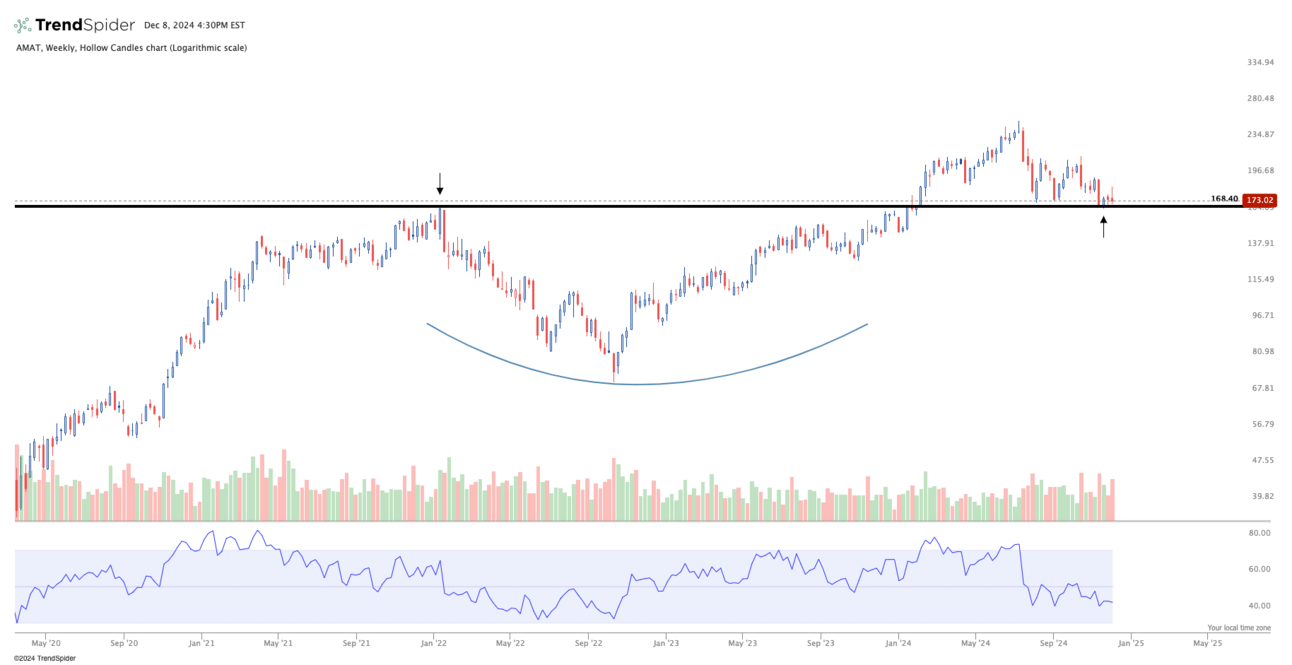

AMAT - Applied Materials: After breaking out of a multi-year base, price is pulling all the way back to the breakout level. This offers a well defined risk, being right under the line, with good potential upside. As long as we can hold this level I am interested.

MSFT - Microsoft: I shared this one last week, and we got a strong close on the week up +4.75%. Looks like this is the first signal of a larger move to the upside and could have a lot more space to move.

TCEHY - Tencent: I believe I shared this chart several weeks back. This falls in line with the China theme I shared last week. Strong breakouts a couple months back across the board for Chinese stocks. We’ve seen a very orderly pull-back/consolidation ever since. I’m watching this area for follow through to the upside after the market finishes digesting those previous gains.

BMO - Bank Of Montreal: Another bank name which is starting to curl up into the right and begin working on the right side of a massive base. This looks like it could just be starting a move back up to all-time-highs. Chart looks great as long as it holds over the line.

Thanks for tuning in this week everyone. A bit of a shorter list, but still a handful of good looking charts out there. I will continue to monitor the market for good set-ups and share them as they come.

Let price action determine your decision making!

Have a great week,

Together We Trade