- Together We Trade

- Posts

- Charts To Watch!

Charts To Watch!

Trade Smarter with these Free, Daily Stock Alerts

It’s never too late to learn how to master the stock market.

You’ll receive daily trade alerts sent directly to your phone and email detailing the hottest stock picks.

The best part? There’s no cost to join!

Expert insights will be at your fingertips instantly.

Hello Traders,

Another notable week for the markets. First Fed rate cut announced Wednesday, followed by all the major indexes printing new gains, with the S&P500 and the Dow Jones Industrial both touching new all-time-highs:

SPY | +1.11% |

QQQ | +1.49% |

IWM | +2.19% |

DIA | +1.36% |

There is a lot of charts to cover in this weeks watchlist, so, I’m not going to waste any extra time and dive straight into things.

Tickers

TPL, TGB, DUOL, CPNG, MTZ, SLV, HACK, MS, AMZN, EPRT, CMRE, WFC, NTRA, CVX, META, ACVA, CIGI, TECHY, IGV, ARKW, NDAQ, BN, MORN, VCTR, MET, XLE, MRO, LOW, AAPL, CET, J, NFLX, INTA, COPX, DOV, EMN, TSLA, TKO, VCEL

Let’s get into this weeks charts:

TPL: Texas Pacific Land Corp is breaking out of a multi-year base formation. As long as price remains over the line, I am interested in being long. I’ve overlaid some fibonacci extensions as targets to trade around.

TGB Taseko Mines was shared with subscribers last week as well. After breaking out of a multi-year base back in April, it had a short run, followed by a pull-back back under resistance. I’m watching to see if price can continue to firm up and make another attempt to reclaim the resistance line. The pull-back we have seen over the past few months has been very orderly and healthy given the strong move it had prior.

DUOL: Duolingo is breaking out of a multi-month basing pattern. Priced rallied pretty hard off the August lows, and could need some consolidation before pushing higher. Nonetheless the breakout is confirmed and now is just a matter of managing risk. As long as it’s over the line I am interested in being long.

CPNG: Coupang is pushing up and into the right as it begins to trade through resistance of this nice multi-year basing pattern. I like this as long as price can hold above the line.

MTZ: MasTec with a massive multi-year base breakout. Price has rejected this line multiple times over the years. Price gave a weekly all-time closing high over resistance last week. As long as price can hold over the line, I’m interested in being long.

SLV: iShares Silver Trust is beginning to push back up through the right side of this massive base. After breaking out in May, price has since consolidated, but is now starting to press up against those former highs. A continuation to the upside looks promising.

HACK: Amplify Cybersecurity ETF forming a really nice multi-year long cup & handle pattern. Price is pressed right up against resistance and looks to be close to a breakout. Watching for a close over the line.

The Rising Demand for Whiskey: A Smart Investor’s Choice

Why are 250,000 Vinovest customers investing in whiskey?

In a word - consumption.

Global alcohol consumption is on the rise, with projections hitting new peaks by 2028. Whiskey, in particular, is experiencing significant growth, with the number of US craft distilleries quadrupling in the past decade. Younger generations are moving from beer to cocktails, boosting whiskey's popularity.

That’s not all.

Whiskey's tangible nature, market resilience, and Vinovest’s strategic approach make whiskey a smart addition to any diversified portfolio.

MS: Morgan Stanley with a really nice multi-year base pattern. Price tested the upper resistance area in July and has pulled-back/consolidated for the past 2 months. I’m watching to see if price can curl all the way back up and give us a breakout attempt to new all-time-highs.

AMZN: Amazon was on our list last week as well. It’s pushing over the resistance line as we close the week, along with good volume coming in to support the move. I’m looking for a continuation to the upside, and I’ve overlaid some fibonacci extensions as targets to trade around.

EPRT: Essential Properties Realty Trust. I have been sharing this chart since it was hovering just over $26. Its been on a steady trend higher since then, and is only just now breaking out of its multi-year base to new all-time-highs. As long as it holds above the line I am interested in being long.

CMRE: Costamare Inc has been shared with subscribers for several weeks. My anticipation is for price to curl out of this consolidation we are seeing and test all-time-highs once again. Las week we finally saw price begin to curl up. I would manage risk under the August lows if price is to reverse.

WFC: Wells Fargo with a multi-year cup & handle pattern in development. We look to be in the handle part of this pattern as we speak. I’m anticipating price to curl back up to resistance and potentially breakout to new all-time-highs. I would manage risk under the August lows if price was to reverse.

NTRA: Natera is attempting to breakout of a huge multi-year base. I wouldn’t be surprised if some consolidation was needed before continued upside, given the magnitude of the recent trend. Regardless, if price can get over the line and hold that level, I am interested.

CVX: Chevron made it onto the list this week. I look at this as a low risk entry against that $135 support level. If price breaks below that, all bets are off. However, RSI is starting to curl up as we rally off the lows. If we begin to see strength in energy this could offer a good opportunity right where it sits.

META: Meta has made a notable move this week as it breaks out over resistance to new all-time-highs. Some consolidation would be totally normal. Nonetheless last weeks trading action signals the beginning of a new trending move. As long as we remain above the line, I am interested in being long.

ACVA: ACV Auctions is beginning to push over resistance as it comes out of this bottoming pattern. As long as price can hold above the line I am interested in being long this name.

CIGI: Colliers International Group closed right at resistance to close the week. Completing the right side of a multi-year base. I am watching for a breakout over the line to signal the next leg higher.

TECHY: Tencent Holdings was shared last week as well. It looks like price is forming the handle consolidation of a cup & handle pattern as a bottom. I’m anticipating price to come back up and meet resistance again around the $52 area. From here I’ll look for a breakout over the black line to signal the next trending move higher.

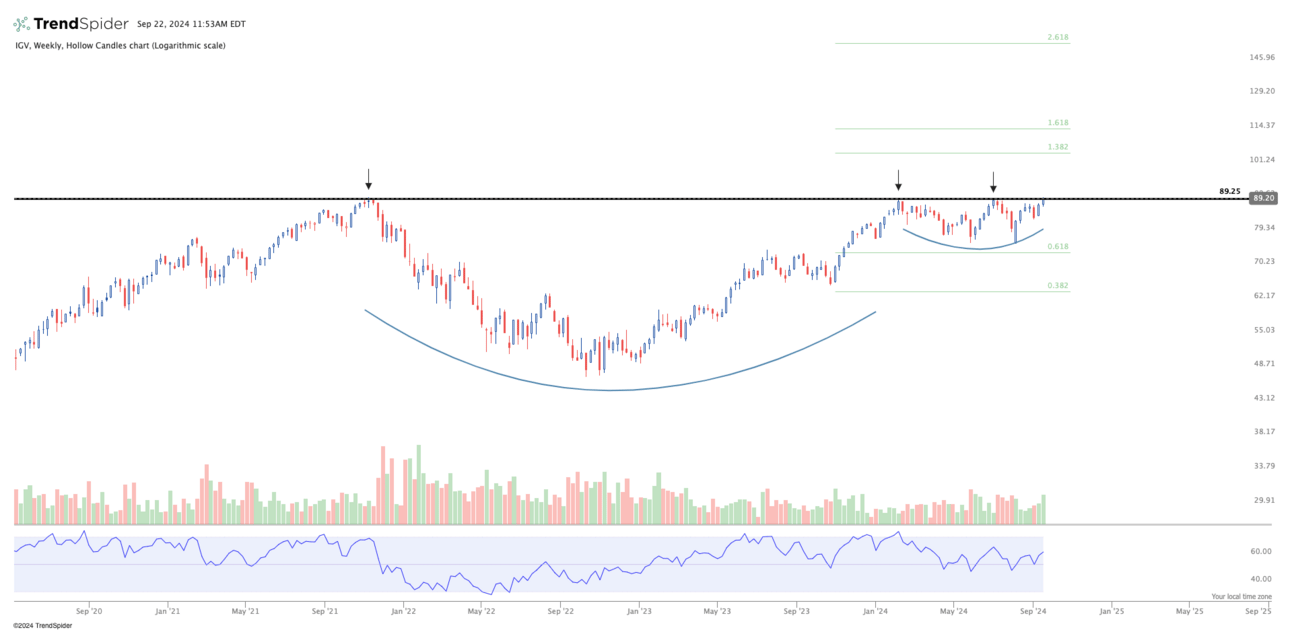

IGV: iShares Software ETF has curled all the way back up to resistance. This name has been shared for weeks now, as price was pulling back from resistance forming the handle of massive multi-year cup & handle pattern.

ARKW: Ark Next Generation ETF has been bottoming for a couple years now. Price has consolidated just under $84 for majority of the year and is now pressing up agains that resistance zone. I’m looking for a breakout over this level to signal the next leg higher.

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

NDAQ: Nasdaq Inc is breaking out of a big multi-year base. The RSI is very high, so, I’m going to wait for a pull-back or some type of consolidation before entering this one. Just because the RSI is high doesn’t mean it has to pull-back, but for my trading approach I avoid buying anything at these extremes. But a pull-back could offer a great opportunity if we get one.

BN: Brookfield Corp is breaking out of a multi-year base. Pretty clear set up, as long as price can hold above the line, I am interested in being long.

MORN: Morningstar has been on the list for weeks now. It’s just starting to curl up over resistance this past week. This is the second attempt it’s taking to push over this resistance line. The consolidation after the first attempt in July has been very orderly and tight, which is a positive sign. Nice volume coming in as it begins to push higher. First target will be the upper resistance zone at $350.

VCTR: Victory Capital broke out of a massive multi-year base back in April, and pushed all the way up to the 1.618 fibonacci extension. It’s consolidated for several months now, and it’s beginning to push up against the former highs. I’m looking for a continuation to the upside if we can get a breakout over $55.

MET: MetLife broke out of a 1.5 year long base last week, signalling the next move higher. Pretty clear setup, as long as price remains over the line I am interested in being long.

XLE: SPDR Energy ETF is back on the list this week. I believe we are at an important level as price rides along support. I’m looking for price to rally off this level, and potentially get a continuation to the upside. If not, risk can be managed very easily just under support. Good risk/reward opportunity if we get follow through.

MRO: Marathon Oil was shared several weeks back. It’s consolidating sideways within a symmetrical triangle pattern. Price has been hanging around the upper resistance bound for months. If energy gets some legs here, I would anticipate a breakout over resistance and then next move higher.

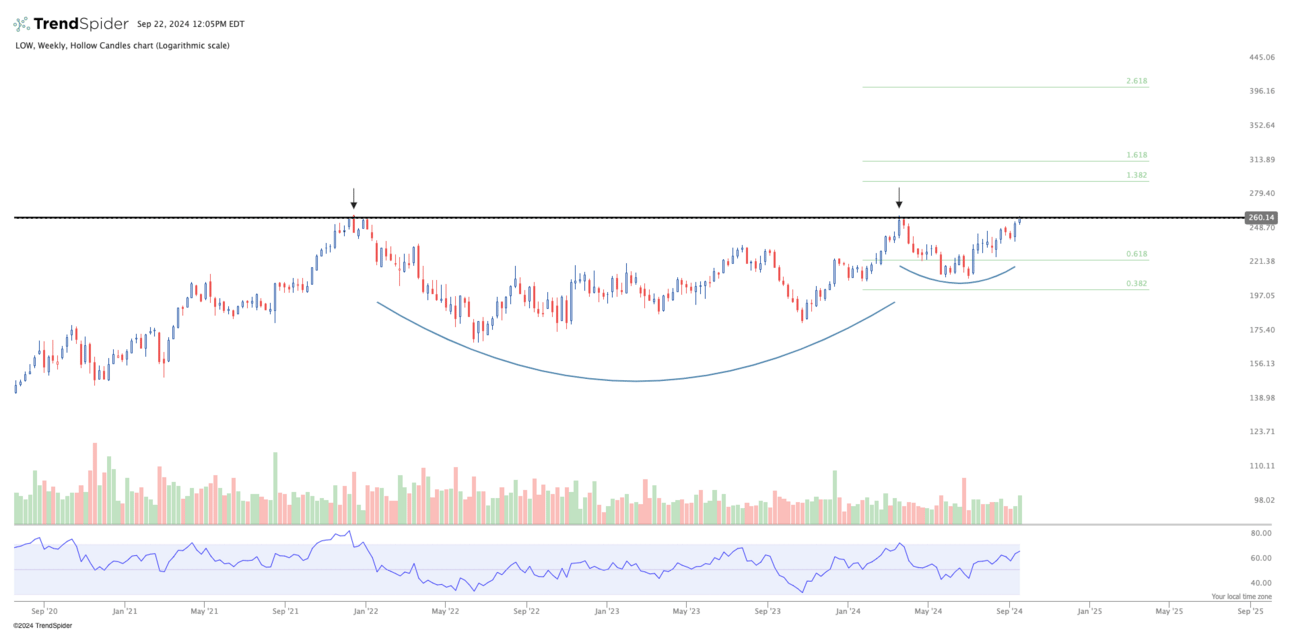

LOW: Lowes was shared with subscribers when this was trading around $230 several weeks back, as I was anticipating price to curl all the way back up to the upper resistance area. We have completed this move, and are now testing all-time-highs. I’m watching for a potential breakout over the line to new all-time-highs.

AAPL: Apple is consolidating after a strong breakout over resistance back in June. It now tests the upper resistance bound as it looks like it may want to continue to the upside. Strong volume coming in last week. I’ll be looking for a push over the $230 level to signal a new move.

CET: Central Securities broke out of a huge multi-year base last week. This is a pretty straight forward setup here, as long as price can hold over the line, I am interested in being long.

J: Jacobs Solutions is back on the list this week. Its been consolidating for several months as it forms the handle consolidation of this multi-year cup & handle pattern. I’m looking for a breakout to new all-time-highs in the coming days/weeks.

NFLX: Netflix is pressing up agains all-time-highs this week. This name has been relentlessly stair stepping higher since the May 2022 lows. We now find ourselves with a completed right side of a multi-year base and a potential for an all-time-high breakout higher. On watch for a close over the line next week.

INTA: Intapp with a 1.5 year long base breakout last week. Strong volume coming in to support the move. As long as price can hold over the black line, I am interested in being long.

COPX: Copper Miners was shared last week as well. I’m anticipating price to curl back up to former highs. Risk can be managed very easily under the August lows. This offers a solid risk/reward opportunity if this plays out. If price breaks below the August lows, all bets are off.

DOV: Dover Corp has been on my list for weeks. Its finally put in a weekly close over resistance as we push up against all-time-highs. Price has been consolidating tightly just under resistance for months now, and looks like it could be at the beginning of the next leg higher. As long as it stays above the line I am interested.

EMN: Eastman Chemical Company is pushing over resistance last week as it breaks out of this multi-year bottoming pattern. I am anticipating price to first complete the right side of this massive base and get back up to those former highs. As long as it trades above the line I am interested in being long.

TSLA: Tesla finally closed over this slanted resistance zone last week. I’ve been stalking this chart for along time in anticipation of this move. The first attempt failed, but price action following that first attempt has been very orderly and constructive. Now it’s giving a second opportunity and looks like it could be in the early innings of much larger move.

TKO: TKO Group Holdings is starting to break out of a year long base. Very straight forward pattern here. As long as price can hold over the black line, I am interested in being long.

VCEL: Vericel Corp is back on the list this week as it continues to consolidate under resistance. I’ve been stalking this chart for a while now, as i anticipate price will curl upward and push over the black line to signal the next leg higher. On watch for now, but I feel a move one way or the other is close.

Thanks for tuning as always. I hope you were able to find some quality trade ideas in this weeks watchlist. Have a great trading week and continue to let price dictate your decision making!

Together We Trade

Noah