- Together We Trade

- Posts

- Charts To Watch!

Charts To Watch!

Hello Traders,

I am back!

I was off for several weeks as I was getting married. Wedding was amazing, everything went perfectly. I am back now, and ready to start talking markets.

Quick index recap:

SPY | +1.18% |

QQQ | +0.78% |

IWM | +1.30% |

DIA | +1.56% |

Quick breadth check:

We are still seeing a expansion in stocks making new 52 week highs versus the number of stocks making new 52 week lows, which is exactlly what we want to see and is indicative of a bull market. The advance decline line also, is steadily rising as the market moves higher. Overall, it’s a pretty healthy back drop for stocks.

Let’s get into this weeks charts!

EPRT - Essential Properties Realty Trust: I shared this chart when it was pushing over the lower blue line. Since we pushed all the way up to new highs. Bit of a consolidation just above resistance is being seen over the past several weeks. Looking for this to continue to the upside.

CIGI - Colliers International: Big multi-year base breakout. Price tucked back under resistance slightly but is starting to push back over the line. As long as this can hold over the black line I’m looking to be long.

AAPL - Apple: Forming a nice multi-month base. Price is testing that upper resistance zone, but hasn’t pushed above the line yet. On watch for a breakout over the line.

HD - Home Depot: This chart was shared with readers back down around the $340 level. Since it’s traded all the way up to former highs where it pulled back (logical level), and is now starting to push in to new all time highs. As long as its over the line I’m interested in being long.

DD - DuPont de Nemours: Big multi-year base. Price tried to breakout several weeks back but quickly tucked back under the resistance line. This looks like a very orderly and normal pull back. I’m watching for a second breakout attempt.

JLL - Jones Lang LaSalle: Another multi-year base. Price is just flirting with the upper resistance zone. I’m watching for a clean breakout over the line.

LOW - Lowes: Another name which was shared with readers back around the $330 level. Since price has pushed all the way up to breakout over new all time highs. We are seeing a breakout retest in the works right now. This pull back looks normal and orderly. I think this is buyable right where it sits with a potential stop below the black line.

CF - CF Industries: This chart looks to be in the process of trying to complete the right side of a massive multi-year base. As long as price can hold over the black line I am interested.

META - Meta: I shared this chart as it broke out over the black line several weeks back. We had a decent move to the upside and now we are getting some consolidation. This looks like very normal price action and I will be watching to see if this can begin to tick higher as this name is in an existing uptrend.

JCI - Johnson Controls: Massive multi-year base breakout. Price is tightly consolidation right over resistance after the breakout. As long as price holds the black line I am interested in being long.

ARLP - Alliance Resources: Nice multi-year base breakout in the works. Price holding over the line, but slightly pulling back last week. As long as this can hold over the line I am interested in trading the long side.

COR - Cencora: Putting in a breakout of this multi-month base. Chart is actionable right where it sits. As long as price can hold over the line I am interested in trading the long side.

XBI - Biotech ETF: This is a monthly chart. This area has been pretty widely discussed lately. The chart is looking like it wants to push up into the right side of what could be a massive multi-year base. It did breakout over this line for a short period of time, and then quickly tucked back under resistance. This is a very volatile sector by nature. Nice volume spike last month which is a positive sign. I’m looking for follow through over the coming months.

MSFT - Mircrosoft: After a massive multi-year cup & handle breakout, price rallied for several months. Now we are seeing price tighten and coil over the past few months. I’m not sure which direction this breaks, but given the preceding trend I will be anticipating a continuation to the upside.

BYD - Boyd Gaming: This is a massive multi-year base. Price is a bit extended when looking at the RSI, so it wouldn’t be unusual if some further consolidation was required. On watch for now, but will be looking for a breakout over the line.

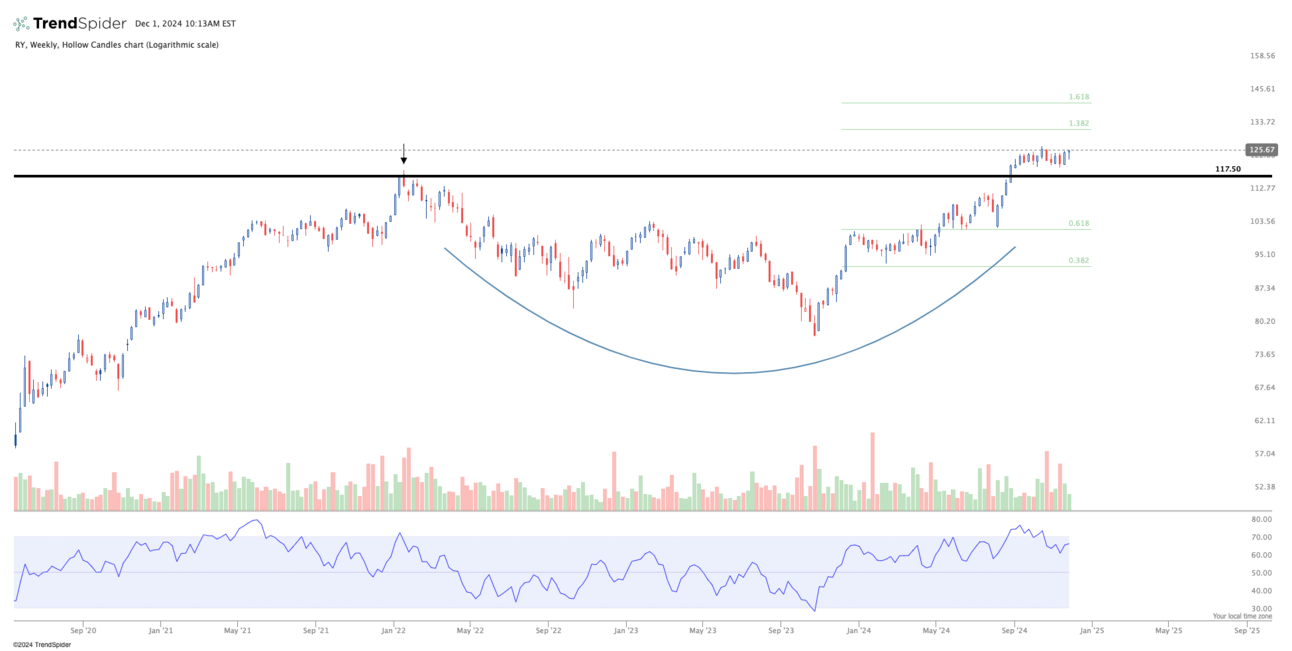

RY - Royal Bank: Beautiful multi-year base breakout, followed by a nice sideways consolidation over the past couple of months. I’m looking for a continuation to the upside on this name.

RBLX - Roblox: Price has been putting in a multi-year bottoming base. We got a clean breakout, and now the retest of resistance turning support. As long as this holds the black line, I am interested in being long.

KWEB - China ETF: Another area which has been widely discussed. We had a monster move off the lows as this shot straight up breaking out over resistance of this multi-year bottoming pattern. Price is tucking back under the line over the past several weeks. I do think this move is not over, and that the market needed to digest the massive move it had. I will be watching this closely for signs of a second breakout attempt.

DNN - Denison Mines: This is a uranium miner. This is a beautiful basing pattern, which has some head & shoulder like characteristics. I’m watching this one for a breakout over the line to signal the next leg higher. The uranium sector is being highly watched given the energy crisis we are seeing.

Alright people, thanks for tuning in as always. Apologies for my absence over the past few weeks without posting any newsletters. I am back now, and excited to get fully back into the swing of things.

As always, let price dictate your decisions. Nothing else!

Together We Trade