- Together We Trade

- Posts

- Charts To Watch!

Charts To Watch!

Join the Revolution in Private Market Investing

All investments have the risk of loss. UpMarket is not associated with or endorsed by the above-listed companies. Only available to eligible accredited investors. View important disclosures at www.upmarket.co

At UpMarket, we make it possible for accredited investors to tap into high-growth private companies. With companies like xAI and Anthropic redefining what’s possible in AI, and SpaceX pushing the boundaries of space exploration, UpMarket’s platform has become a gateway for future-focused accredited investors. Join our network of 500+ investors who have placed over $175M in private opportunities since 2019.

That was one hell of a week! Last week I said I’m remaining more defensive going into the week. Definitely wasn’t the wrong move... Pretty nasty price action across the board:

QQQ | -2.24% |

SPY | -2.16% |

DIA | -2.46% |

IWM | -4.78% |

Obviously the breadth data is still weakening. However, like I said last week, this doesn’t mean the bull market is over. To me this seems more like a pull-back within a rising market. Aggressive yes, but still needed to sustain further upside. This is very similar to what we’ve seen several times in this bull market.

One component I am paying attention to is the US dollar. We’ve seen a clear negative correlation between equities and the dollar over the years. This relationship hasn’t always acted in the same fashion, however, its something worth paying attention too as the dollar looks like it may be starting to break out. This could cause some headwinds for US equities if it continues. I’m not saying they can’t move up together, but it has had an impact on equities before, and is something to consider going forward.

The top frame is the US dollar compared to the bottom frame the S&P500 index:

There are a lot of charts out there which are simply pulling back at logical levels, which look to be in the process of setting for potential trades in the coming weeks/months. I still am planning to remain defensive, and wait for the market to digest the recent action. I’m hoping we don’t take out the lows from last week and can stabilize from this point onward.

Tickers:

MNKD, UHAL, BLFS, SQ, ZG, COIN, JCI, XLK, ADUS, DRI, FNKO, ACVA, AB, H, CNP, SCVL, SSB.

Let’s get into this weeks charts!

MNKD - MannKind Corp: Broke out of multi-year base and is now retesting its breakout level. It crossed below the line last week, but recovered very quickly. This is a positive sign. As long as it can stay above this level I like this chart.

UHAL - U-Haul: Still consolidating right below resistance. Very good looking chart overall. I’m watching this one for a second crack at testing those highs and potential breakout opportunity.

BLFS - BioLife Solutions: Still working on the right side of a massive multi-year base. Price tucked under support lat week, but again reclaimed the line very quickly. As long as it holds over this line, I like this chart.

SQ - Block: The bottom base breakout is now tucking back in and testing the support. If this level holds, this could be a great entry point. As long as it holds the line I like the chart.

ZG - Zillow Group: Broke out of this bottoming base and is now consolidating and pulling back into the support zone. As long as price holds over the line I like this chart.

COIN - Coinbase: Currently pulling right back into its breakout level. I want to see this level hold next week. With Bitcoins weakness it’s definitely weighing on it’s upside momentum.

JCI - Johnson Controls: Multi-year base breakout and now retest of the breakout level. We need to see this level hold going forward. Of it can’t hold this level, then this name may need to be put back on watch for another opportunity in the weeks/months to come.

XLK - Technology ETF: Price pulled back under the breakout level, but managed to finish with a bit of strength on Friday. I would like to see last weeks lows hold and price to reclaim the line to signal a new trade opportunity.

ADUS - Addus HomeCare: This one finished the week green despite the markets action. Breaking out of a multi-year base, consolidating for several weeks, and amidst a terrible week in the market, it reclaimed the breakout level. Definitely a name I’m watching closely.

DRI - Darden Restaurants: Breaking out of a year and a half long base. Breaking out on strong volume closing well over the breakout line. Chart looks great as long as price stays above the line.

FNKO - Funko Inc: Multi-year bottoming base in the works. Price is testing that breakout level into the close on the week. Watching this for a breakout over the line to signal the next leg higher.

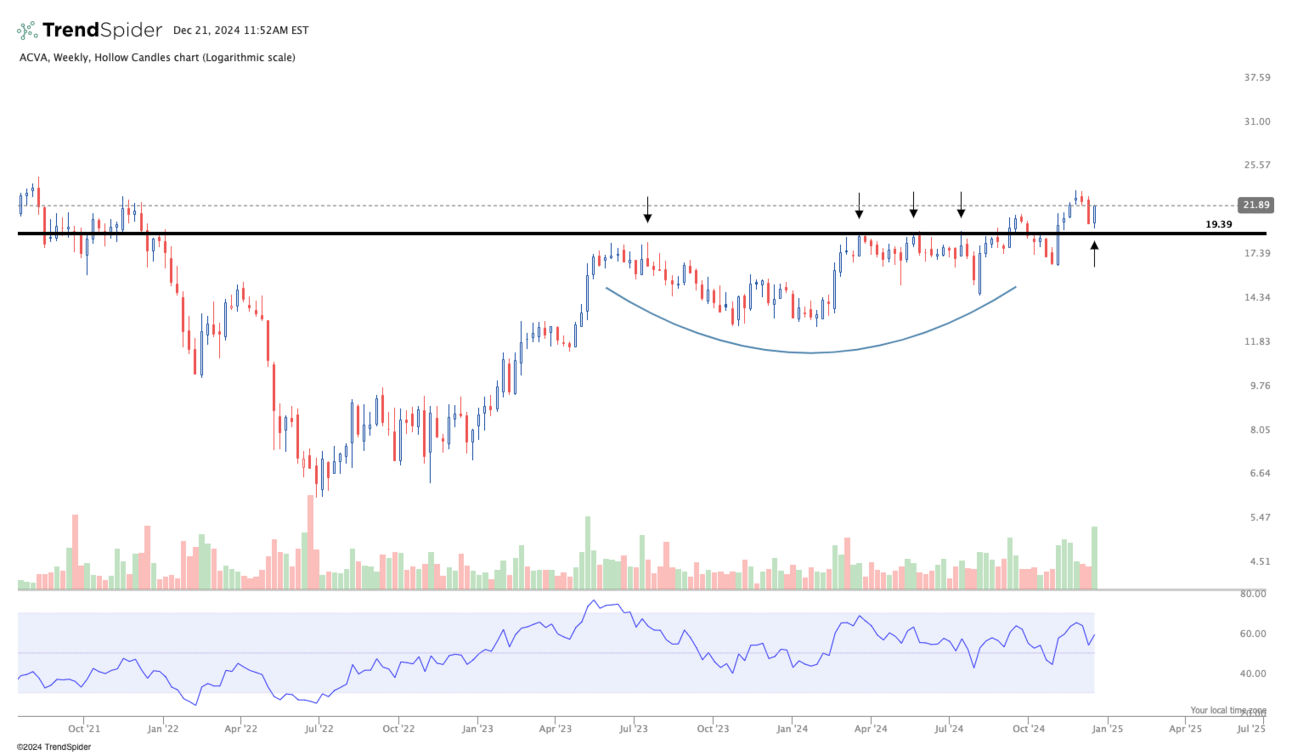

ACVA - ACV Auctions Inc: Broke out of a nice base several weeks back and has now pulled back to the breakout level which is acting as support. Volume pattern on this chart looks very good as well. As long as the line holds this chart looks great.

AB - AllianceBernstein Holdings: This looks like its in the beginning stages of starting the right side of what could be a massive base. Big volume coming in last week as it closes the week up nicely. This could take some time to unfold, but if this can stair step higher and not take out the previous weeks lows, this could offer a solid opportunity.

H - Hyatt Hotels: Just shy of a year long base. Price is flirting with resistance as it closes the week. Traded down slightly in the week, but managed to close in the upper end of its range. Watching this for a breakout over the line.

CNP - Center Point Energy: Really nice clean multi-year base. Price is trading for several weeks just under resistance. I’m watching this closely for a push over the line to signal the next move higher.

SCVL - Shoe Carnival: This one continues to form what looks to be the handle of a multi-year cup & handle pattern. I like this trade idea right where it sits, with a stops below these lows. Offering a decent risk/reward opportunity. The idea is that this can curl up to the previous highs and set up for a new all-time-high breakout.

SSB - SouthState Corp: This is a monthly chart. I shared this name with readers in previous weeks before it broke out over resistance. Price is tucking back in slightly after the breakout but is well above the line still. This could offer a decent pull-back entry to capture continued upside. Again, as long as the line holds I am interested.

Thank you for tuning in! Hopefully we have a better week next week, but at the end of the day we have to respect price action. My most recent trades I’ve taken have not found themselves in the green early. Many are sitting at small losses and even some have been stopped out. When trades are working, be more aggressive. When they aren’t, be more defensive. There’s always an endless amount of data points you can consider when make trading decisions, but nothing is more telling and important than if your trades are working.

Have a great week!

Together We Trade