- Together We Trade

- Posts

- Charts To Watch!

Charts To Watch!

Hello Traders,

Not the greatest of weeks for the indexes. Selling has persisted across the board:

SPY | -1.94% |

IWM | -3.39% |

QQQ | -2.20% |

DIA | -1.83% |

Breadth: There has been an expansion in net new lows, 1 & 3 month lows, as well as the advance decline line turning back down for the S&P 500. Definitely feels like it’s going to require more time for the environment to shift to begin getting more interested in buying stocks. Bull market is still in tact, but are amidst a pull back within that trend, and new opportunities are now showing up as easily.

Another thing I touched on over the past couple of weeks is the US Dollar DXY. This has continued to breakout, which has been putting pressure on equities. All in all, it’s been a challenging environment to be long stocks.

Commodities: Despite the indexes, I am seeing some action in several commodities which looks positive. Crude, copper, silver, gold and natural gas have all perked up last week. This has my attention for potential opportunities.

CL Crude Oil - Rallying off the lows and rising into a downward sloping resistance level. Definitely will require some time to really shape up, but worth keeping on your radar.

NG Natural Gas - Breaking out of a large base, retesting the breakout level, and rallying once again. This looks very constructive to me.

SI Silver - Broke out over a long standing resistance line. Chopped around for a bit, definitely not the cleanest look. But nonetheless it’s now rallying off that lower resistance line which looks to be acting as support. Potential silver may perform in the coming weeks/months.

HG Copper - Bouncing off a long standing lower support line. Perking up over a shorter term slanted resistance line. Giving early signals that copper may begin to perform.

Tickers:

GSG, GMED, ARLP, EOG, CF, WAT, SLV, AEM, HD, KGC, PLNT, COPX, GEV, CET, YMM, TNL, SMH, SPGI

Let’s get into this weeks charts!

GSG - iShares Commodity ETF: After a massive move to the upside, this has been in consolidation mode since May 2022. Last week it popped nicely over this slanted resistance line. Looks like this could be the very beginning of a larger move.

GMED - Globus Medical: Multi-year base with a breakout over resistance last week. If it can hold the line going forward, I will remain interested.

ARLP - Alliance Resources: Still on the list for several weeks. This small handle being formed on this multi-year cup and handle has continued to curl higher. On watch for a breakout over resistance.

EOG - EOG Resources: multi-year consolidation in the works. It’s not broken out yet, however with crude turning up recently, I want to be on watch for a breakout in the coming weeks.

CF - CF Industries: Still on the list. Still consolidating at resistance. The longer it does this without moving lower the better. I’m anticipating a pop over resistance to get things moving. Still waiting for that signal.

WAT - Waters Corporation: Big multi-year base in the works. Its traded over resistance for several weeks, managing to hold the line reasonable well. As long as it remains in tact and holds the line I am interested. A completion of the right side of this base would be target number one up at former highs.

SLV - iShares Silver Trust: As stated above, this broke out of a big base and is now retesting those breakout levels. It’s a bit choppy, but none the less its showing positive technical signs. If we can hold the line I am interested.

AEM - Agnico Eagle Mines: Massive multi-year base with a consolidation right at resistance. I want to see this push over this line and hold it. Looks to be working on that as we speak.

HD - Home Depot: Failed the initial breakout of this massive base. Pulling back under resistance and looks to be forming a bit of a handle, or consolidation. On watch for price action to start curling higher from here.

Fortune Favors The Bold

Ever wish you could turn back time and invest in Amazon's early days? Well, buckle up because the AI revolution is offering a second chance.

In The Motley Fool's latest report, dive into the world of AI-powered innovation. Discover why experts are calling it "the rocket fuel of AI" and predicting a market cap 41 times larger than Amazon's.

Don't let past regrets hold you back. Take charge of your future and capitalize on the AI wave with The Motley Fool's exclusive report.

Whether it's AI or Amazon, fortune favors the bold.

KGC - Kinross Gold: Massive multi-year base. Price tested those highs and has been consolidating just under resistance ever since. Last week price perked up and looks like it may want to take a crack at a breakout.

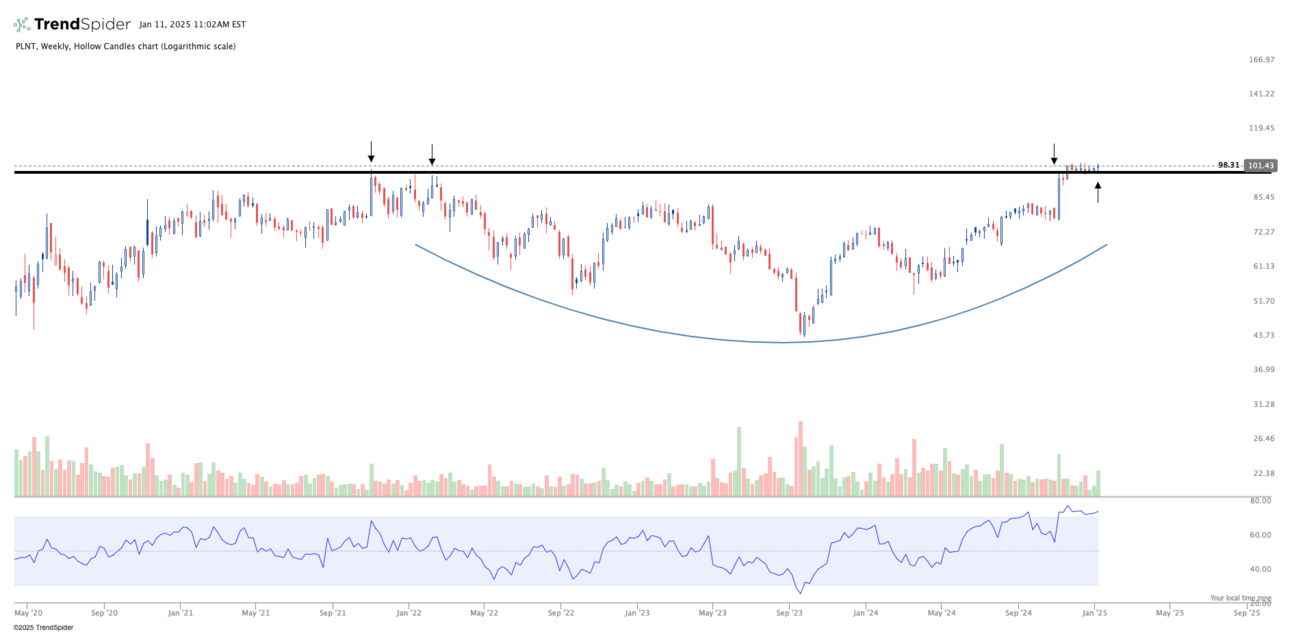

PLNT - Planet Fitness: Massive multi-year base. Price tightly consolidating just above resistance. Maybe it’s a new years resolutioner thing, but this looks quite good where it sits. If it drops below the line i won’t be interested. But if it remains to hold it, I like this chart a lot.

COPX - Copper Miners ETF: We have what appears to be a large cup & handle pattern. Price tested upper resistance several times, even attempting to breakout one time. Failing the breakout and consolidating under resistance ever since. I want to see price start to curl higher from here.

GEV - GE Vernova: Pretty strong price action in this name. Pulling back ever so slightly after breakout out, but quickly bouncing back. Overall I really like this chart right where it sits. If we break down below the line, I’m obviously no longer interested.

CET - Central Securities: Still on the list. Breakout retest chart. That lower line needs to hold. It’s been holding for now, but I want to see a strong candle come in and give a bit of a rally to show me this level is meaningful and will hold.

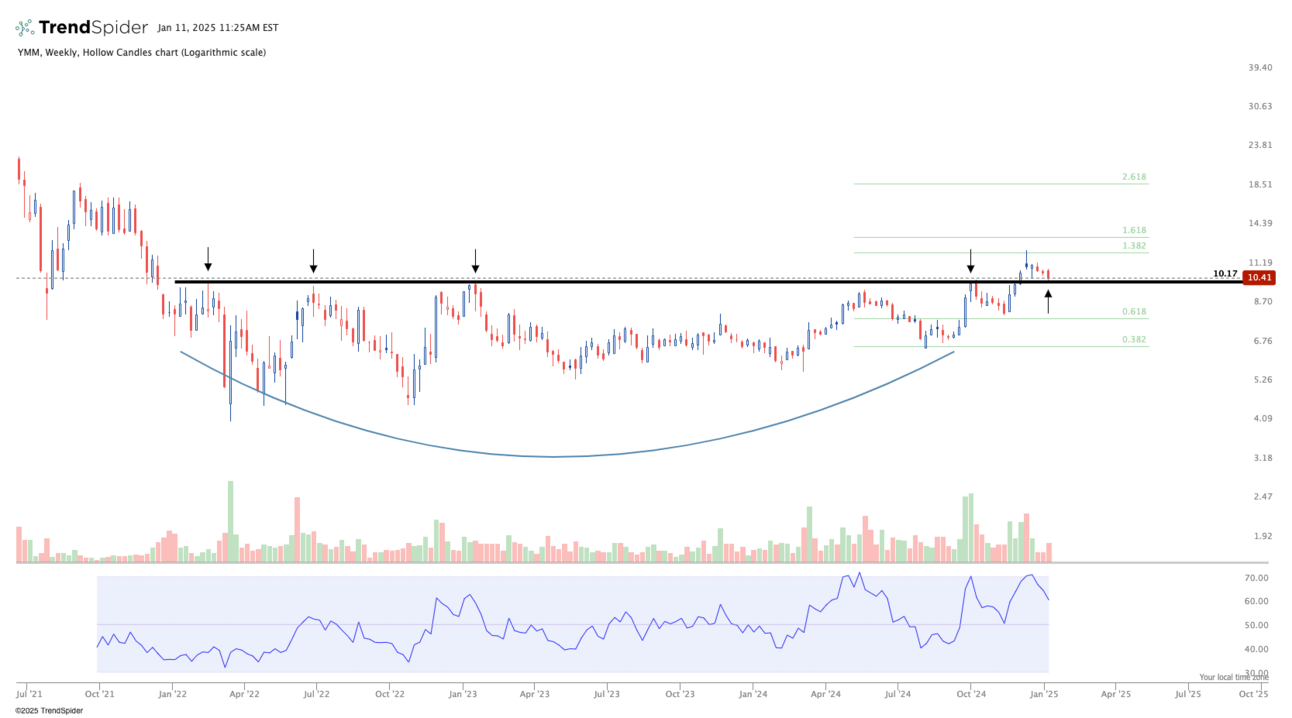

YMM - Full Truck Alliance: After breaking out of a massive bottoming base, we are retesting that breakout level. As long as the lower line holds I am interested.

TNL - Travel Leisure: Back on the list again. Breaking out of a massive bottoming base, and now pulling back to its breakout level. If the line holds I am interested.

SMH - Semiconductor ETF: We got the breakout last week, but have pulled back fully after breaking out. Not exactly what I want to see, but if we can hold the 50 day moving average along with the slanted support level, this will keep me interested. Definitely a frustrating outcome, but there is still hope that this can firm up.

SPGI - S&P Global Inc: Broke out a massive base and has retested the breakout level. This is the second time testing this support area. Currently the rising 50 week MA is catching up with price, and I’m hoping this can give the stock a lift as we test this support zone. Next week should be telling.

Thanks for tuning in as always.

I remain quite defensive right now. Many of my stops have been triggered, and most new trades that were placed, have quickly failed. That’s all I need to see happen to know the environment is not working in my favour. Regardless, I am firmly watching for areas of strength and for new setups to emerge to begin telling me to get more aggressive.

Have a great week!

Together We Trade