- Together We Trade

- Posts

- Charts To Watch!

Charts To Watch!

These daily stock trade alerts shouldn’t be free!

The stock market can be a rewarding opportunity to grow your wealth, but who has the time??

Full time jobs, kids, other commitments…with a packed schedule, nearly 150,000 people turn to Bullseye Trades to get free trade alerts sent directly to their phone.

World renowned trader, Jeff Bishop, dials in on his top trades, detailing his thoughts and game plan.

Instantly sent directly to your phone and email. Your access is just a click away!

Hello Traders,

Apologies for not getting out a newsletter last week. I am only a few weeks out from my wedding, and my time has become extremely restricted. I will not be putting out a newsletter next week unfortunately. Once all the wedding festivities are past, I will get back my regular weekly posts.

Clearly the markets are experiencing a bit of turbulence. Not unexpected given the amazing run we’ve had. Very normal for the market to take a breather as we are beginning to see:

SPY | -0.95% |

QQQ | +0.17% |

DIA | -3.0% |

IWM | -2.66% |

There haven’t been as many set-ups that match my style/criteria as of late. So, I have a pretty short list of stocks I’m interested in. Hopefully new set-ups begin to emerge in the coming weeks.

Tickers:

SG, TEL, UHAL, NVDA, CIGI, CPRX, IGV

Let’s get into this weeks charts:

SG: SweetGreen testing the horizontal resistance zone. I’m interested if we can get a break above the line.

BKR: Baker Hughes consolidating just under resistance. On watch for a breakout over the line to signal the next let higher.

TEL: TE Connectivity in a nice consolidating as it works on the right side of what looks to be a massive multi-year base. I like an entry right around where it sits with a stop just below the $140 area. Good risk to reward opportunity.

UHAL: U-Haul failed the first breakout. I’m watching for a entry on this pull-back. Waiting for price to find some support and intend to scale in below resistance and add on a breakout if we get it.

NVDA: Nvidia is tightly trading over resistance. As long as it holds over the line I am interested in being long.

CIGI: Colliers International with a beautiful multi-year base breakout. As long as we hold over the line I am interested being long.

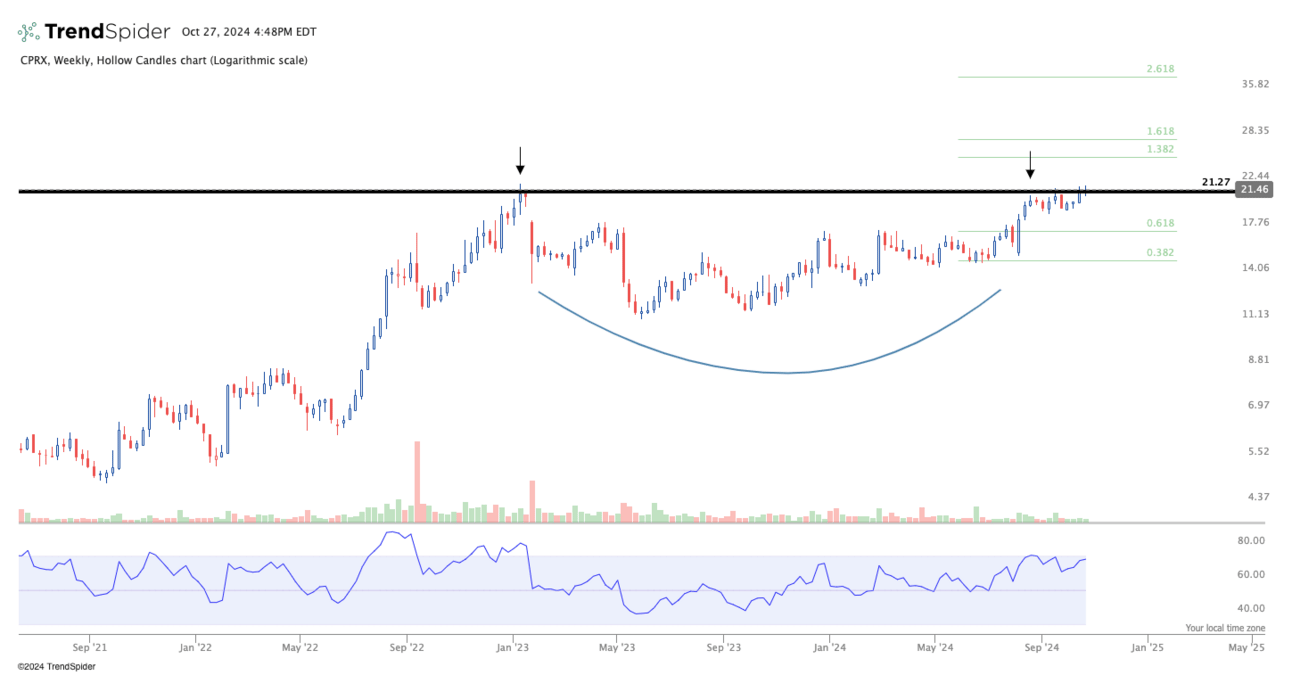

CPRX: Catalyst Pharmaceuticals tightly trading at resistance. I’m looking for price to push over the line to signal the next leg higher.

IGV: Software ETF broke out of a massive cup & handle pattern. We are getting slight pull-back which overs a decent entry. As long as price holds over the line I am interested. If it breaks below, all bets are off.

A lot less charts than normal. This comes at a time the markets are experiencing a pull-back after a strong rally, which all makes perfect sense. We need to remain patient for new set-ups with good entries to emerge. As we see more and more set-ups emerge, the likeliness of getting follow through will increase. I remain cautious in the short-term but bullish in the long term. As always let price dictate your decisions. Patience pays.

Have a great week!

Together We Trade

Noah