- Together We Trade

- Posts

- Charts To Watch!

Charts To Watch!

Smart Investors Are Betting On A.I. Stocks—Are You?

Experts say Trump’s $500B A.I. investment plan could transform the industry.

Meanwhile, a small but ambitious A.I. healthcare company just went public after eight years of innovation, securing $18M in funding and partnering with industry giants.

With a $120M market cap and shares still under $2, this stock may not stay cheap for long.

Hello Traders,

Another volatile week in the books. Similar to the DeepSeek fiasco a couple weeks ago where markets gapped down Monday morning, we had the Tariff scare gives us the second big gap down this past Monday. Similar to the previous week also, we managed to recover throughout the week, but were met with selling pressure into Friday to close the week. The indexes after it all were pretty much unchanged to finish the week.

INDEXES

SPY | -0.17% |

QQQ | +0.12% |

IWM | -0.21% |

DIA | -0.51% |

BREADTH OUTLOOK

Outside of Monday, which was the day the markets gapped down quite aggressively, the markets managed to display relatively decent breadth throughout the week. The S&P 500 managed to print positive 1 & 3 month new highs, as well as positive net new highs throughout the week. It’s evident that the pace these breadth indicators are expanding has slowed over the past weeks. But as breadth expands, it has to also contract and so on and so forth. Overall, no major warning signs being flashed just yet despite the volatility being seen in the market, but things can change fast. We can only observe what has actually happened thus far.

US DOLLAR INDEX (DXY)

The US Dollar index has rolled over the past couple of weeks, which is a positive back drop for equities. It rallied off a pretty well defined support level around $107, and has quickly began to fade back towards this support level. It’s always worth keeping an eye on what the DXY is doing, as equities tend struggle amidst a rising dollar. If this continues to break down this would be positive for risk assets.

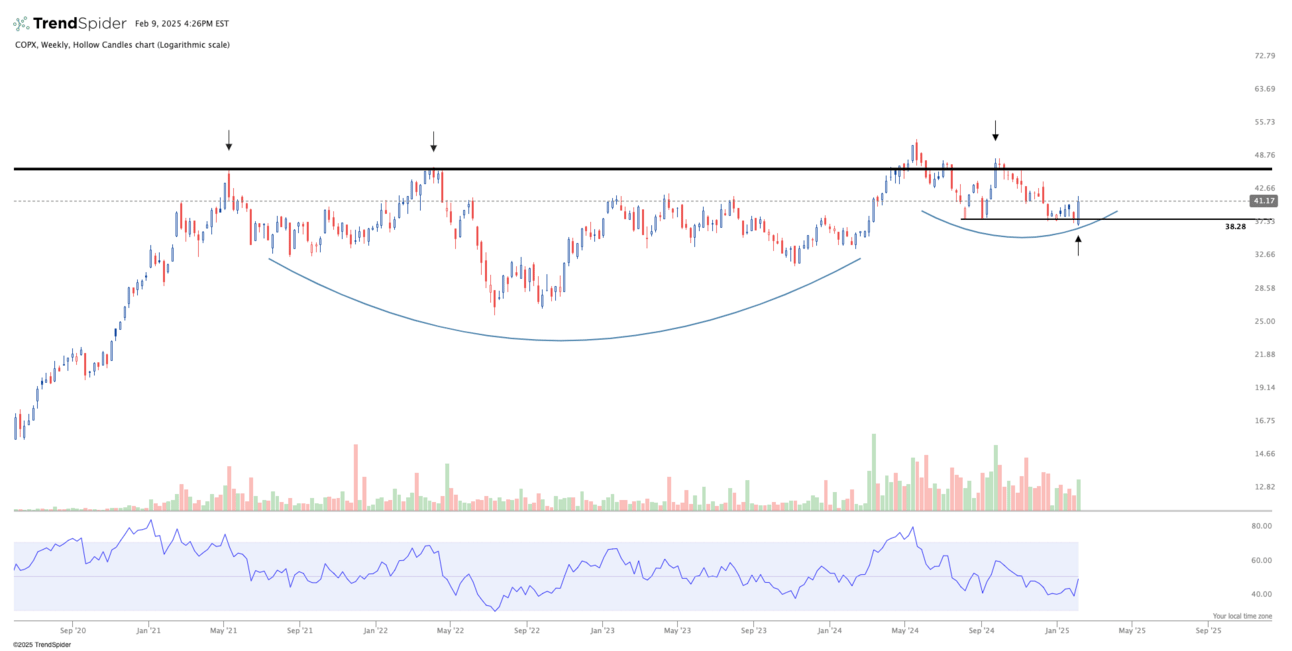

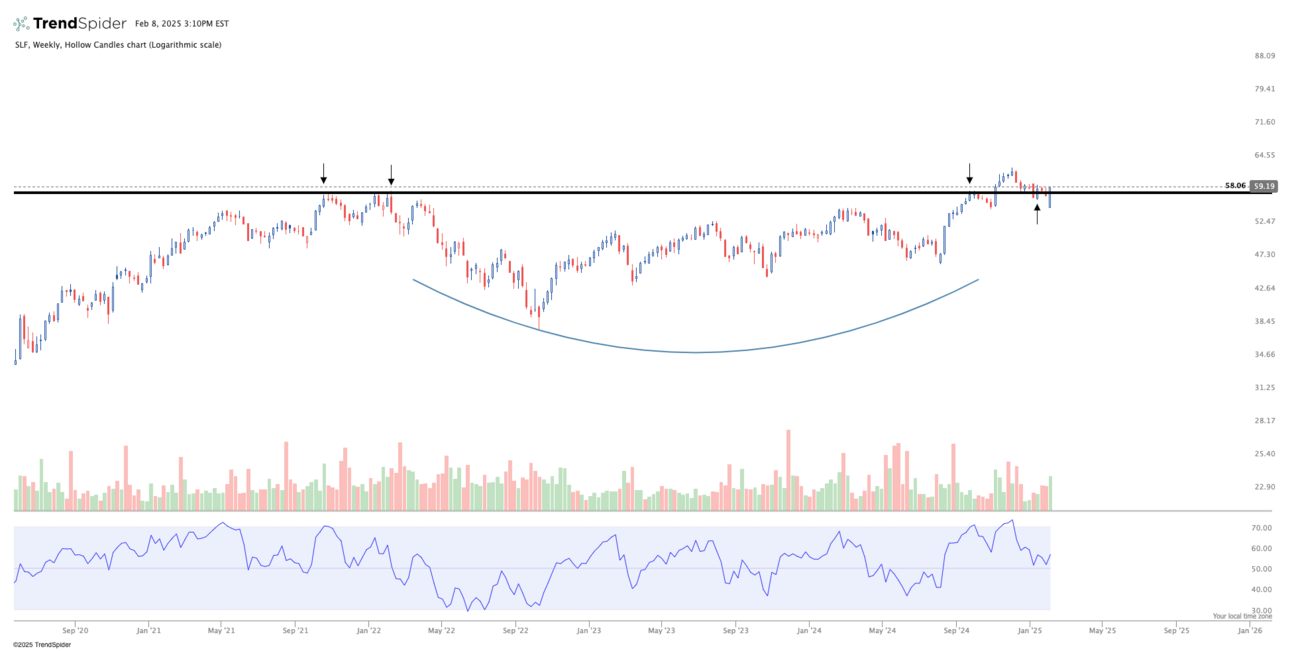

It’s clear there has been some rotation happening out there. Many of the Magnificent 7 stocks have experienced turbulence lately, while other areas of the market are starting to perk up. Commodities such as copper, silver and gold have all been breaking out which is notable when looking for themes in the market. Many of the Chinese tech stocks have also gained traction. There have also been several real estate names showing up on my scans as well. So I’m keeping an open mind, and happy to participate in what is working and step away from what isn’t.

TICKERS

SLV, COPX, RERE, LGCY, GRAB, KWEB, SLRC, REG, LAMR, SLF, DE, UHAL, BYDDF, TSLX, MCD, KIM, CNP, MORN, CCAP, ZWS, CFR, EPRT, PLMR, H, JLL, MC, CLOV

Let’s get into this weeks charts!

Make sure to check for earnings, as many of these names have earnings coming up!

Thank you for tuning in as always. Have a great week of trading!

Together We Trade