- Together We Trade

- Posts

- Charts To Watch!

Charts To Watch!

Hello Traders,

For the first time in a while, we saw a green weekly close across all the major indexes. While it wasn’t a significant move, it’s a step in the right direction.

Is this the bottom?

No clue… But unless there is a recession in the works or some other major event to pull the rug out from under our feet, I assume we are close to the lows for the market. I’m still open to the idea that we get another spike in volatility and potentially retest of the lows before it’s all said and done, but I think we just need to be patient. I’m not expecting a V-shaped recovery by any means. Would be nice, but not my base case. As more stocks begin setting up with strong technical patterns, we will know the environment we are in is healthy.

INDEXES

SPY | +0.21% |

QQQ | +0.25% |

IWM | +0.44% |

DIA | +1.03% |

BREADTH OUTLOOK

We have the NYSE chart on top followed by the net highs/lows for the S&P 500, then the Nasdaq, and NYSE in the below pains. There was certainly a bit of improvement across the board from the previous weeks, but nothing to write home about. Work still needs to be done. We finished the week green, but we will need a bit more juice to step in to fuel markets higher.

Last week, I maintained a relatively cautious approach, initiating only a single new position in AMD. Beyond that, I spent most of the week observing the broader markets movements. This week, I plan to remain equally selective with new trades, as there’s no urgency to force entries prematurely. Take opportunities as they present themselves, but exercise disciplined risk management with each move.

TICKERS

BBIO, LQDT, HOLX, GM, CVX, EE, EPRT, CTRA, COPX, MELI, AX, USO, EXE, EQT

Let’s get into this weeks charts!

BBIO – BridgeBio Pharma: The stock has adhered to a descending resistance line for several years, repeatedly testing its upper boundary. Recently, it has established a well-defined base, with price consolidating tightly just below this key resistance over the past several weeks. A decisive breakout above this level could signify the initiation of a new upward trend.

LQDT – Liquidity Services: The stock achieved a decisive breakout from a multi-year base in December and is now in the process of retesting the breakout level. Provided that the prior resistance successfully holds as support, this setup remains compelling for potential upside continuation.

HOLX – Hologic Inc.: The stock is currently trading within a well-defined rectangle pattern, a classic consolidation structure. Price is now testing the lower boundary of this range, accompanied by a notable spike in volume last week. Additionally, the RSI is beginning to rebound from deeply oversold levels. This setup appears favorable for a potential long opportunity, provided the lower boundary holds as a support level.

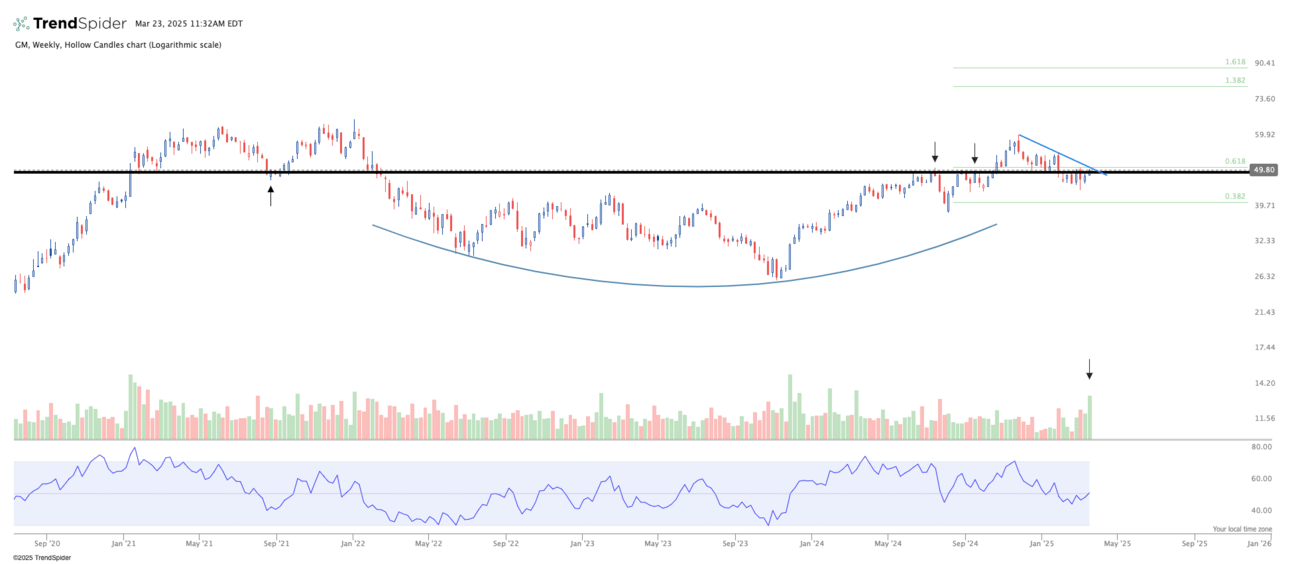

GM – General Motors: The stock appears to be constructing the right side of a substantial multi-year base. In recent months, price action has pulled back into a key support level, forming a consolidation zone. Notably, there has been an uptick in volume, suggesting increasing interest. This pullback appears to be a healthy and orderly consolidation within the broader trend. I’m looking for some confirmation and a push out of this consolidation to the upsdie.

CVX – Chevron: The stock has achieved a decisive breakout above a downward-sloping resistance zone that has been in play since 2022. This breakout signifies a notable shift in character for Chevron, indicating renewed strength and suggesting the potential for continued upside momentum.

EE – Excelerate Energy: The stock is developing a significant cup-and-handle formation, with price currently consolidating to form the handle. A breakout above the resistance line would confirm the pattern. A partial position could be initiated at current levels, with a stop-loss set below the February lows, as a breach of this level would invalidate the setup. Should the stock break above the upper resistance line, it may provide an opportunity to add to the position.

EPRT – Essential Properties Realty Trust: This stock has repeatedly earned a spot on my watchlist, thanks to its formation of a massive multi-year cup-and-handle pattern. Currently, it is developing the handle consolidation just beneath a key resistance level. A breakout above this resistance would serve as a strong signal for the next leg higher.

CTRA – Coterra Energy Inc.: The stock has been forming a well-defined base over the past year and a half, repeatedly testing the upper resistance level without yet achieving a decisive breakout. A clean move above this key resistance would signal the potential for the next leg higher, making it a setup worth monitoring closely.

COPX – Copper Miners ETF: Admittedly, I was stopped out of this name a few weeks ago, only to watch it rally shortly after. However, the chart now appears to be back in play. Copper is showing relative strength, and COPX is beginning to push higher. While there's still some work to be done, the ETF seems to be forming the handle of a multi-year cup-and-handle pattern. Though the formation is somewhat choppy, the overall structure remains intact. If entering a long position here, I would place a stop below the lows from three weeks ago.

MELI – MercadoLibre: The stock recently attempted a breakout from a multi-year cup-and-handle formation but quickly pulled back to key support, likely influenced by broader market weakness. I’m closely monitoring for signs of renewed momentum to the upside in the coming weeks. It’s crucial for price to hold above the breakout level to maintain a constructive outlook.

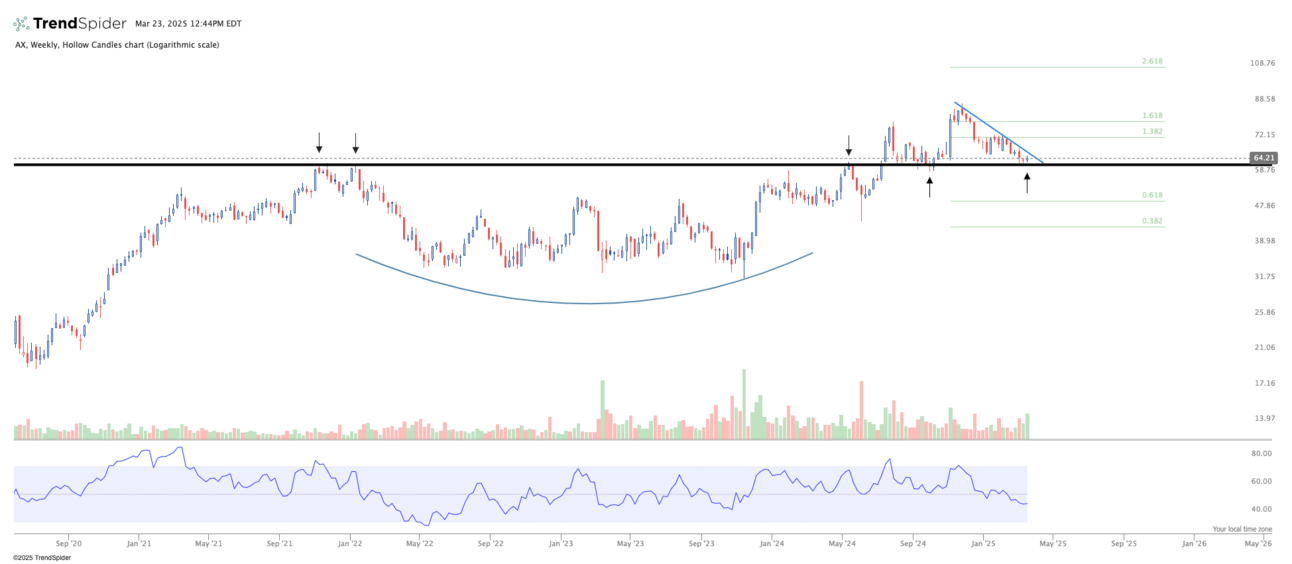

AX – Axos Financial: The stock achieved a breakout from a multi-year base in July, followed by a solid rally. Since then, it has retraced back to the breakout level, which is now acting as support. As long as this support holds, the setup presents an attractive risk-to-reward trade opportunity.

USO - United States Oil Fund: I’ve been stalking this chart. Oil has been beaten down, but many energy stocks are rallying. This has built a really nice multi-year base and price looks like it could be forming a potential handle consolidation as we speak. We need some confirmation still, however, I’m watching closely to see if this can start to curl back up to resistance. From there I will be looking for breakout. If I was to place a trade at these levels, I would have a stop just under the recent lows. Have to manage risk tightly until this proves itself.

EXE – Expand Energy Corp.: The stock is exhibiting a well-defined multi-year base, with price now retesting the upper resistance zone. Recent price action, accompanied by a significant surge in volume last week, suggests the potential for a breakout. I’m watching for a decisive move above this resistance level to confirm the next leg higher.

EQT – EQT Corporation: The stock has formed a well-defined multi-year base and recently attempted a breakout above resistance, only to pull back below the level. It is now making a second attempt to clear this key resistance. I’m closely monitoring for a decisive breakout, which would signal the start of the next leg higher.

Have a great week everyone. Stay nimble, and prepared for anything. Let price tell the real story.

Together We Trade