- Together We Trade

- Posts

- Charts To Watch!

Charts To Watch!

Trade Smarter with these Free, Daily Stock Alerts

It’s never too late to learn how to master the stock market.

You’ll receive daily trade alerts sent directly to your phone and email detailing the hottest stock picks.

The best part? There’s no cost to join!

Expert insights will be at your fingertips instantly.

Hello Traders,

Another week down. the S&P500, Dow Jones, and Nasdaq printing very moderate gains. And the Russel 2000 pulling back a half a percent to finish the week. Definitely nothing write home about from last week:

SPY | +0.26% |

QQQ | +0.12% |

IWM | -0.54% |

DIA | +0.11% |

Energy, however, did stand out last week. A number of energy charts made it onto the watchlist this week. I’ve been sharing the XLE chart for the past couple of weeks as it had been testing its lower support level. I was anticipating a potential move off the lows, and that is exactly what we got last week. There is definitely follow through needed, however this is a good start for the energy space:

As always, there are lots of charts to cover this week, so let’s get right into things.

Tickers

EAT, AMD, WFC, PRIM, AFG, MS, FBK, ARKW, AMZN, GFL, IGV, DASH, XOM, EOG, RL, SSB, MRO, NFLX, HACK, URNM, NVDA, CF, LNG, BX, UHAL, SLV, BRX, GRAB, EXLS, VERX

Let’s get into this weeks charts:

EAT: Brinker International is breaking out of a massive cup & handle pattern. This chart is actionable right where it stands. As long as price remains over the line I am interested.

AMD: Advanced Micro has been consolidating/pulling-back since March. This pull-back feels quite orderly, and comes after a large trending move in price. I am anticipating this name to begin resolving higher from here. Price is reclaiming resistance and I want to see it hold over the line to stay interested.

WFC: Wells Fargo is still on the list. It continues to consolidate after rejecting off resistance on a failed breakout attempt. I would trade this agains the August lows to manage risk. I’m looking for price to begin resolving higher from here.

PRIM: Primoris Services is giving a nice pull-back bounce off resistance which has now turned support. As long as price continues to hold over the line, I am interested in being long.

AFG: American Financial is breaking out of a nice 8 month cup and handle pattern. As long as price can hold over resistance, I am interested in trading the long side.

MS: Morgan Stanley officially breaking out of this massive multi-year cup and handle pattern. As long as price remains over the line, I am interested in trading the long side.

FBK: FB Financial Corp is still on our list. It’s tightly consolidating right under resistance. A push over the line would signal a long trade. I continue to watch this closely for a breakout of this multi-year base.

ARKW: ARK Next Generation ETF continues to test the upper resistance line. I am watching for a breakout over this zone to signal the next leg higher. Price has been slowly stair stepping higher since December lows. Watching to see if this trend can continue.

AMZN: Amazon remains on the list. Price continues to trade right at this long standing resistance zone. A push over the line is what I am looking for as starting point, and then for price to clear those former highs at $201. This is a massive basing pattern, and when/if it does breakout, I don’t want to be left behind.

GFL: GFL Environmental recently rejected the former highs at $43.45 and is putting in a very orderly pull-back. I am watching this in anticipation of price firming up and curling back towards those highs for another attempt. Could take a little bit of time to unfold, but keeping this name on watch for now.

IGV: iShares Software ETF is still on our list. Price continues to test resistance of this massive cup and handle pattern. On watch in anticipation of a breakout to new all-time-highs.

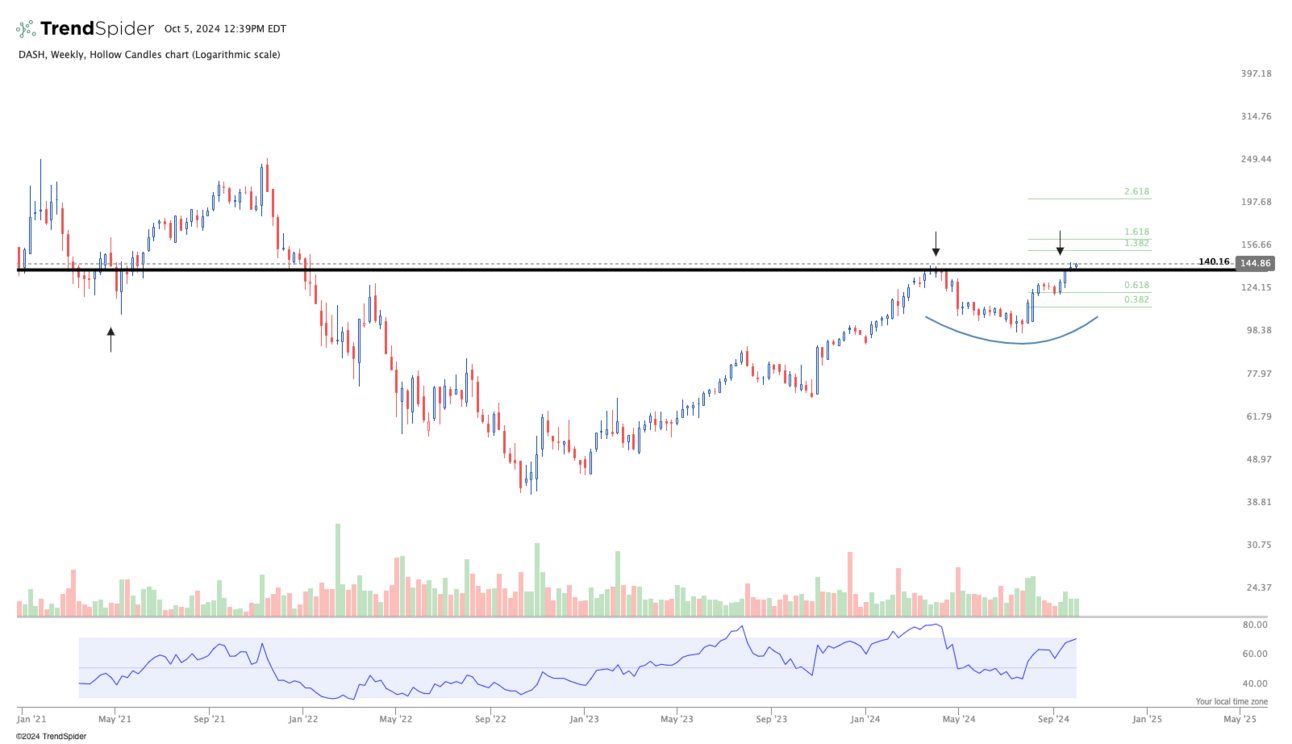

DASH: DoorDash is beginning to breakout of a smaller multi-month base, as it continues to build off the 2022 lows. It’s had a strong trending move since the lows of 2022 and developed this base as it looks to be digesting that previous move. Now setting up for the next leg higher.

XOM: Exxon is breaking out to new all-time-highs. As energy begins to firm up, Exxon is leading the way early on, pushing to new all-time-high territory. As long as price stays above the line, I am interested.

EOG: EOG Resources, another energy name to watch, is looking like it may breakout of this multi-year symmetrical triangle. If energy continues to show strength I will be interested to see if this can breakout of this pattern.

If you're frustrated by one-sided reporting, our 5-minute newsletter is the missing piece. We sift through 100+ sources to bring you comprehensive, unbiased news—free from political agendas. Stay informed with factual coverage on the topics that matter.

RL: Ralph Lauren is on my list once again. This chart is extremely clean. This is the monthly chart, with a massive base, and a tight consolidation right under resistance, followed by a breakout over the line. As long as price holds above the line, I am very interested in being long this name.

SSB: SouthState is on the list yet again. I love this monthly chart. Massive base breakout, followed by a tight consolidation right above resistance. I am expecting this to resolve higher if the market environment remains positive.

MRO: Marathon Oil is also back on the list. Like EOG, I expect this to breakout of this multi-year triangle pattern if energy continues to show strength.

NFLX: Netflix is also back on the list this week. Price continues to trade in a very orderly fashion above resistance. As long as it can stay over the line, I like this trade on the long side.

HACK: Amplify Cybersecurity ETF is beginning to push over resistance of this massive multi-year cup and handle pattern. If price can hold over the line, I am interested in being long.

URNM: Uranium ETF is back on the list. I don’t overly love this pattern, as there is lots of work to do still. Nonetheless, there is a lot going on in this space currently, and price is beginning to rally hard off the recent lows. Price is reclaiming this support level which has held all the way back since October 2020. I would like to see price hold this line, and begin to firm up from here as a starting point.

NVDA: Nvidia is back on the list again. Price continues to trade in this triangle pattern, but is trading right up agains the upper resistance zone. I am anticipating a breakout of this pattern and a continuation to the upside.

CF: CF Industries Holdings is beginning to push up into the right side of what could be a massive multi-month base pattern. I like this to the long side as long as price action can stay above the line. This could be an early entry to a much larger move.

LNG: Cheniere Energy is also breaking out to new all-time-highs as energy shows strength. This chart is actionable right where it stands. As long as price can hold over the line I am interested in being long,

BX: Blackstone was shared with viewers prior to this massive base breakout back around $127. It’s since made a great move to the upside, breaking to new all-time-highs, and is now putting in an orderly pull-back as former resistance looks to potentially act as a support level. I like this trade idea right where it sits.

UHAL: U-Haul is back on the list. We have a massive cup and handle breakout. Price is just hovering over resistance to close the week. I am watching for follow through. As long as price holds over the line I am interested in being long.

SLV: Silver looked like it was going to breakout on Friday as it began trading above the line, but tucked back under resistance to close the week. I am watching this to see if it gives a second opportunity next week.

BRX: Brixmor Property Group with a massive multi-year base breakout, followed by an orderly pull-back retest of resistance turned support. As long as price can hold the line, I am interested in being long.

GRAB: Grab Holdings has been trading under this resistance level since March 2022. I’m watching for a breakout over this line to signal a new leg higher. Until then, this remains on watch.

EXLS: ExlServices is starting to breakout of this large basing pattern. RSI is a bit high, so I wouldn’t be surprised if this needs a little consolidation before moving higher. But regardless I am keeping a close eye on this name for an opportunity to trade the long side.

VERX: Vertex is breaking out of this massive 3 and half year long base. As long as price holds over the line I am interested in being long this name.

Thanks for tuning into this weeks watchlist. Have a great week everyone, see you next week!

Together We Trade

Noah