- Together We Trade

- Posts

- Charts To Watch!

Charts To Watch!

Trade Smarter with these Free, Daily Stock Alerts

It’s never too late to learn how to master the stock market.

You’ll receive daily trade alerts sent directly to your phone and email detailing the hottest stock picks.

The best part? There’s no cost to join!

Expert insights will be at your fingertips instantly.

Hello Traders,

Not a bad week overall. The Dow Jones & S&P500 both touched new all-time-highs this week. All major indexes minus the Russell 2000, printed moderate gains on the week:

QQQ | +0.89% |

SPY | +0.57% |

DIA | +0.57% |

IWM | -0.56% |

There are plenty of charts to cover this week, so, I’m going to jump straight into things!

TICKERS

BKR, ZIM, AN, ARGX, XLE, UHAL, LOW, NTRA, AOS, NXPI, TEL, EXPD, SLNO, DD, CRM, J, RL, HACK, MS, NFLX, COPX, GWW, FCX, CIGI, CROX, LRCX, NVDA

Let’s get into this weeks charts:

BKR: Baker Hughes is trading within this multi-year ascending triangle. Price is pressing up against that upper resistance zone. I am waiting for a breakout over the horizontal resistance zone to signal the next trending move.

ZIM: Integrated Shipping Services bottomed in November 2023, and has since been working its way higher. Its approaching a previous resistance level, and forming a consolidation right under this zone. I am looking for a breakout over the horizontal resistance boundary to signal the next move higher.

AN: AutoNation has formed a year long base, and is pressing up against it’s upper resistance level as we close the week. I’m looking for a breakout over the horizontal resistance line to signal a continuation to the upside.

ARGX: Argenx SE was on our list in previous weeks. Price has developed a year long base and is currently testing those former highs. It is tightly consolidating right below resistance as we close the week. I am watching for a breakout over the horizontal resistance line to signal the next move higher.

XLE: SPDR Energy ETF is on our list yet again. Price action remains lacklustre, however, it is testing support, which has been holding since 2022. The RSI is also at a level where often a bounce can occur. I look at this as a low risk entry with a stop below the September lows.

UHAL: U-Haul Holdings is breaking out of a multi-year base/cup & handle pattern as it presses into new all-time-high territory to close the week. The chart is actionable right where it sits. As long as we hold the over the line I am interested.

LOW: Lowes was shared several weeks ago as price was forming the handle of this multi-year cup & handle pattern. We are now breaking out over our horizontal resistance boundary to new all-time-highs. As long as we hold over the line, I am interested in being long.

🦾 Master AI & ChatGPT for FREE in just 3 hours 🤯

1 Million+ people have attended, and are RAVING about this AI Workshop.

Don’t believe us? Attend it for free and see it for yourself.

Highly Recommended: 🚀

Join this 3-hour Power-Packed Masterclass worth $399 for absolutely free and learn 20+ AI tools to become 10x better & faster at what you do

🗓️ Tomorrow | ⏱️ 10 AM EST

In this Masterclass, you’ll learn how to:

🚀 Do quick excel analysis & make AI-powered PPTs

🚀 Build your own personal AI assistant to save 10+ hours

🚀 Become an expert at prompting & learn 20+ AI tools

🚀 Research faster & make your life a lot simpler & more…

NTRA: Natera is flirting with resistance after completing the right side of this massive multi-year base. I would not be surprised if price needs to interact with this level for a short period of time before testing higher prices. But nonetheless I want to make sure I am monitoring this chart for a clean push above the horizontal resistance boundary.

AOS: A.O. Smith Corporation is breaking out of a multi-year cup and handle pattern. It made two attempts to breakout over the horizontal resistance level, but failed both times. Last week we blasted through this level, making a new weekly closing high. As long as we remain over the line I am interested.

NXPI: NXP Semiconductors broke out of a multi-year base back in February, and like many semiconductor names, it’s experienced a very healthy pull-back. Price has fully retraced back to its breakout level offering potential for a low risk/reward trade opportunity. As long as price can hold this level, I am interested.

TEL: TE Connectivity Ltd is still in the process of completing the right side of a multi-year base. Price looks to be in a minor consolidation as it continues to stair step up into the right. I’ve been taking more of these consolidation/pull-back entries within these broad basing patterns as they offer better risk/reward and often can become profitable quite quickly. If you want to remain cautions, I would wait for a breakout over line to signal the next leg higher.

EXPD: Expediters International was on our list weeks back. Its now managed to trade its way back up to former highs, testing resistance once again. I am watching for a breakout over this horizontal resistance zone to signal the next leg higher.

SLNO: Soleno Therapeutics was shared two weeks back. It had made an attempt to breakout over resistance but quickly failed, and tucked back under the line. Price is pulling back to the 0.618 fibonacci level, and looks to be finding some footing. I am keeping this on watch for another attempt at a breakout over the horizontal resistance zone.

DD: DuPont De Nemours is breaking out of a massive multi-year base. The strategy is quite simple, as long as price can hold over the horizontal line, I am interested in being long.

CRM: Salesforce looks to be in the process of developing the handle on a large multi-year cup & handle pattern. An entry could be taken here with a stop below the June lows or you could wait for this to work its way back up to resistance to see if it gives a breakout to new all-time-highs.

J: Jacobs Solutions has been on our list for weeks. Price has developed a multi-year cup & handle pattern. Last week it broke out over resistance with some force and looks to be setting up for the next leg higher. As long as price can remain over the line I am interested in being long.

Whiskey: The Tangible Asset for Your Portfolio

Most people fail to diversify their investments.

They invest all their money in intangible assets like stocks, bonds, and crypto.

The solution - fine whiskey.

Whiskey is a tangible asset, providing a unique appeal compared to other investments. Casks of whiskey have measurable attributes like size, age, and weight, making their value indisputable. This physical nature allows for clear identification of issues and adjustments to safeguard future value.

Vinovest’s expertise in managing these tangible assets ensures your whiskey casks are stored and insured to the highest standards, enhancing their worth over time. Discover how this tangible, appreciating asset can enhance your investment portfolio.

RL: Ralph Lauren has developed a massive multi-year price base. This is a monthly chart, so this horizontal resistance level has acted as resistance going all the way back to 2012. Last week price has started to push through this resistance zone. We still have another trading day in the month to see if this level holds. But nonetheless this chart looks fantastic and could offer a great trading opportunity.

HACK: Amplify Cybersecurity ETF is back on the list. Price has developed a really nice multi-year cup & handle pattern and price is just beginning to test over this long standing resistance zone. It still needs a stronger close over the line to give me stronger conviction, but either way this chart is looking great.

MS: Morgan Stanley with a multi-year price base. It’s put in a slight consolidation right under resistance, which is something I often like to see. I’ll be watching to see if we get a price breakout over the line to signal the next leg higher

NFLX: Netflix is ever so subtly pushing through those former highs. The trend has been steady, as this continues to stair step higher. The approach is simple, if price can hold over the line I am interested in being long.

COPX: Copper Miners ETF was on our list last weekend. It had a massive move this past week and is now on everyone’s radar. Price has managed to climb all the way back up over it’s resistance zone. I think some consolidation would be normal given how quickly this rallied off the lows. Nonetheless I like a long trade in this name against the horizontal resistance line.

GWW: W.W. Grainger is breaking out of a nice 7 month base. The approach is quite simple, as long as price can hold above the line, I am interested in playing the long side.

FCX: Freeport was also shared for the past couple of weeks as a pull-back opportunity. Last week it blasted all the way back up to resistance. I’m not watching this for a breakout over resistance to signal the next leg higher. I would think some consolidation would be very normal given the sharp move it just had.

CIGI: Colliers International has formed a big multi-year base. Price is flirting with resistance as we close the week. I am watching for a stronger close to carry us over this resistance line. This will signal the next leg higher.

CROX: Crocs was shared months back as this tried to break through resistance in June. Unfortunately, it failed and pulled back under resistance. Price is now beginning to curl back up, and is approaching resistance again. I am watching for a second breakout opportunity over this resistance line,

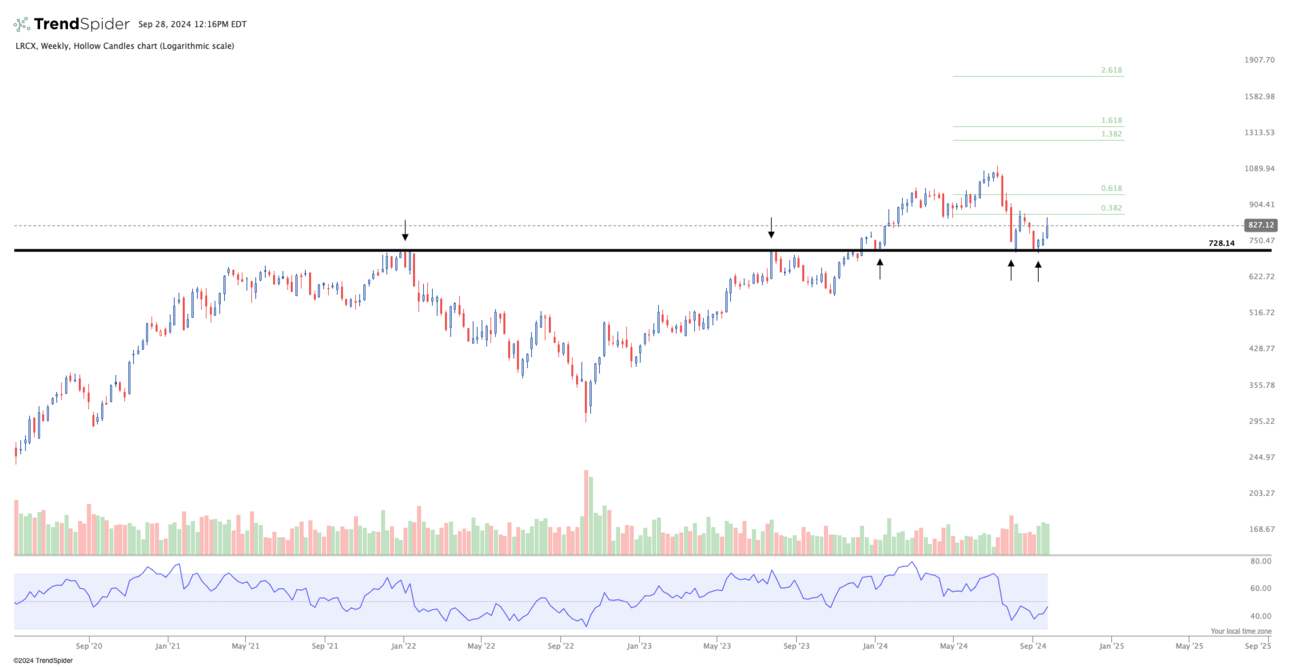

LRCX: Lam Research broke out of a big base back in December 2023, making a strong move to the upside following that. However, more recently it has pulled all the way back that breakout level, where its acting as support. As long as price can hold over the line, I am interested in trading the long side.

NVDA: Nvidia made it onto the list for the first time. Price has been forming a nice consolidation after having made a significant move. We now trade within this symmetrical triangle pattern. Price is testing that upper resistance area as we close the week. I am interested in getting long if this can start to push over the upper bound and signal a new move higher.

Thanks for tuning in to this weeks watchlist. I’ll see everyone again next week!

Have a great trading week.

Together We Trade

Noah